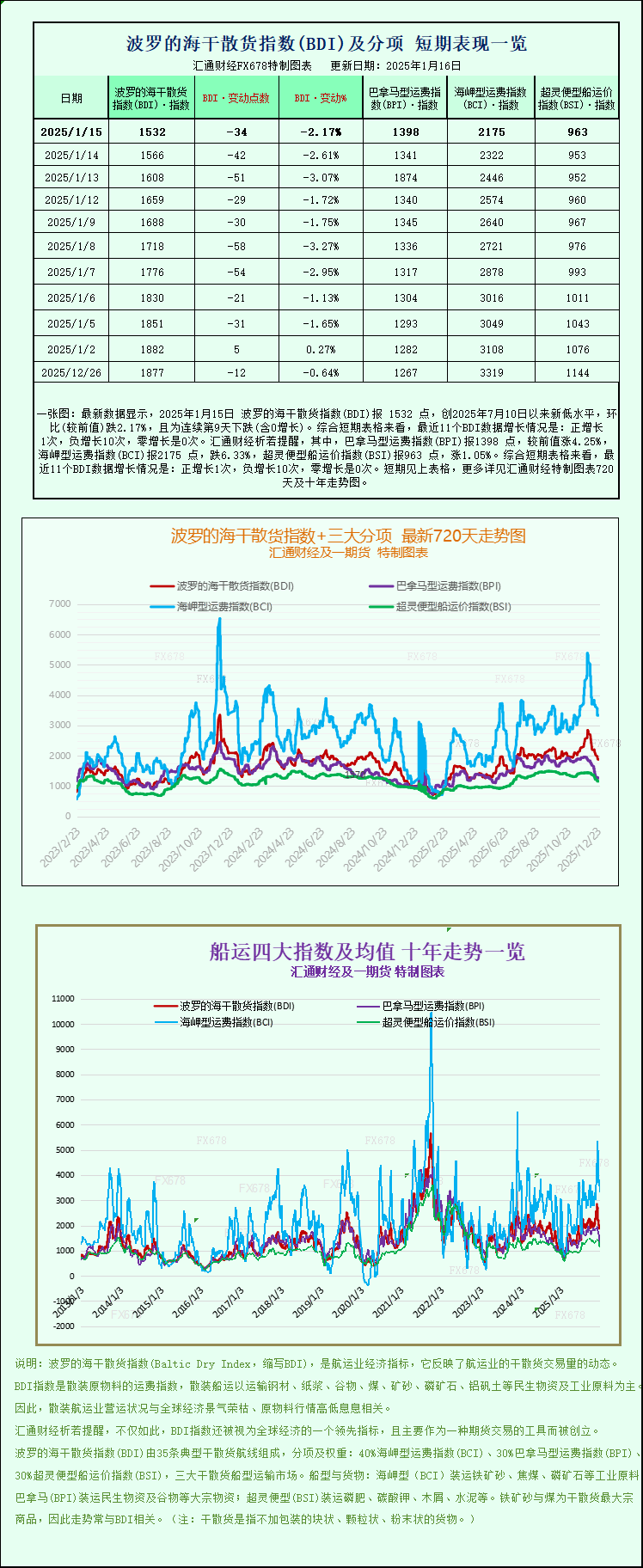

A chart shows that the Baltic Dry Index has fallen for the ninth consecutive trading day, with the Capesize sector dragging down the index significantly.

2026-01-15 23:04:43

On Thursday, the Baltic Dry Index fell for the ninth consecutive trading day, mainly dragged down by weak performance in the Capesize segment. This index primarily reflects freight rate trends for dry bulk cargo vessels, and its continued decline highlights the pressure on certain sectors of the current dry bulk shipping market.

Specifically, the main index covering Capesize, Panamax, and Supramax freight rates fell 34 points, a drop of 2.2%, to close at 1532 points. While this decline did not set a new single-day record recently, the downward trend over nine consecutive trading days reflects the overall cautious market sentiment and the structural weakness of some sectors.

As the core factor dragging down the index, the Capesize index performed particularly poorly, falling sharply by 147 points, or 6.3%, to close at 2175 points. Capesize vessels are the "juggernauts" of dry bulk shipping, typically transporting 150,000 tons of bulk cargo, mainly industrial raw materials such as iron ore and coal. Their freight rates are closely related to global steel production and energy demand. Affected by this, the average daily earnings of Capesize vessels declined accordingly, decreasing by $1334 to $16226. This earnings level is significantly lower than the same period last year, putting some pressure on the profitability of related shipping companies.

The weakness in the Capesize vessel sector is directly related to the sluggish performance of the iron ore market. As the world's largest importer and consumer of iron ore, China's post-holiday production recovery has slowed, leading to a decline in pig iron production. This has directly put pressure on iron ore demand, dragging down iron ore futures prices. Iron ore transportation demand is the core business of Capesize vessels, and the weakness in demand directly impacts freight rates and profitability, creating a chain reaction. It is worth noting that the pace of resumption of work and production after the Chinese New Year holiday often has a short-term impact on the global dry bulk market, and the slower-than-expected recovery this time has further amplified the volatility of the Capesize vessel sector.

In stark contrast to the sluggish performance of the Capesize vessel sector, the small and medium-sized vessel sector showed a structural recovery. Among them, the Supramax vessel index rose slightly by 10 points to close at 963. Supramax vessels have a moderate deadweight tonnage and are highly adaptable, mainly transporting agricultural products and small-batch minerals. They are relatively less affected by fluctuations in a single commodity, and this slight increase reflects the stability of market demand for them.

The Panamax index performed strongly, rising 57 points, or 4.3%, to close at 1398. Panamax vessels typically transport cargo of 60,000 to 70,000 tons, primarily coal and grain. The rebound in freight rates and earnings reflects a phased recovery in global demand for energy and agricultural products. Simultaneously, the average daily earnings of Panamax vessels increased by $513 to $12,585, providing some profit support for related shipping companies and offsetting, to some extent, the downward pressure on the Capesize sector.

Overall, the current dry bulk shipping market exhibits a differentiated pattern of "weak large vessels and strong small vessels," driven primarily by the varying cargo demands corresponding to different vessel types. Capesize vessels continue to weaken due to sluggish demand for iron ore in China, while Panamax and Supramax vessels remain resilient thanks to robust demand for energy and agricultural products. Future market trends will hinge on the combined impact of factors such as the progress of China's resumption of work and production, changes in global iron ore and coal demand, and adjustments in international shipping capacity supply.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.