With the US-EU trade war reigniting, are US Treasury bonds and the dollar losing their safe-haven appeal?

2026-01-19 18:23:21

The US dollar index has recently shown a clear volatile pattern. In the early morning, affected by the escalating sovereignty dispute between the US and Europe over Greenland, the exchange rate fell sharply, testing the key support level near 99.00.

European Commission President Ursula von der Leyen issued a strong warning about the US tariff threats, stating that the move risks triggering a dangerous vicious cycle in transatlantic trade relations.

US-EU tariff battle: Escalating geopolitical conflict weighs on the dollar's performance.

The core geopolitical event that triggered market volatility stemmed from the US imposing tariffs on Europe.

On Saturday, US President Donald Trump announced that he would impose a 10% punitive tariff on imports from EU member states, including Denmark, Sweden, France, Germany, the Netherlands, and Finland, as well as the UK and Norway. The measure will officially take effect on February 1.

The immediate trigger for this tariff policy was the collective condemnation by EU member states of the US's proposed "full acquisition" of Greenland.

In response to the US tariff threat, the EU acted swiftly, with EU member states clearly stating that they would take appropriate countermeasures. European Commission President Ursula von der Leyen went further, making a strong statement through the X platform, emphasizing that "territorial integrity and sovereignty are core principles of international law, and imposing tariffs will seriously damage transatlantic relations and could trigger a dangerous downward geoeconomic spiral."

From the perspective of long-term pricing logic in the exchange rate market, this event will have a substantial negative impact on US-EU bilateral relations and will likely force Europe to accelerate the process of diversifying trade settlement currencies. This move will fundamentally weaken the US dollar's status as a global reserve currency and exert long-term pressure on the US dollar index.

Key short-term events: Pricing logic driven by both policy and geopolitics

In the short term, the convergence of policy window and geopolitical competition will dominate the pricing logic of the US dollar index.

The 56th World Economic Forum (WEF), which opens next week, is one of the key focuses. This grand event in Davos, Switzerland, has attracted global attention to President Trump's keynote speech on Wednesday, whose geopolitical and trade policy signals may have a direct impact on market sentiment.

The core inflation data that the Federal Reserve uses as a policy anchor—the November Personal Consumption Expenditures (PCE) data—will be released on Thursday. Coupled with the stronger-than-expected US CPI data this week, this data will become a key basis for judging the timing of the central bank's interest rate cut cycle.

Current market implied probabilities indicate a 61% chance of the first interest rate cut this year at the June meeting. If inflation slows more than expected, the expected rate cut could be implemented sooner, thus exerting substantial downward pressure on the US dollar index.

Safe-haven assets are showing unusual activity, with the US dollar and US Treasury bonds softening from their lows.

This escalating rivalry between the US and Europe has also triggered unusual activity in safe-haven currencies, with a significant increase in safe-haven buying of the Swiss franc, which has strengthened across all major global currency pairs.

Driven by risk aversion, gold broke through to new highs. However, it is worth noting that the US dollar index chose to move downwards under the combined influence of various factors, while the continued rise in US Treasury yields also indicates that US Treasuries are actually being sold off. This suggests that in this event, safe-haven assets did not favor the US dollar or US Treasuries, which may indicate that the market is concerned about their status as safe-haven assets.

Federal Reserve signals: another path to interpreting the US dollar and US Treasury bonds.

US President Trump stated that if you want to know the truth, he actually wants you to stay in your current position, and he may not want National Economic Council Director Hassett to become Federal Reserve Chairman.

Following Trump's comments, both the market probability of former Federal Reserve Governor Warsh becoming the Fed chairman and the yield on U.S. Treasury bonds rose, with investors believing that Warsh may not be as aggressive as Hassett in pushing for interest rate cuts.

However, dovish comments from Federal Reserve Vice Chair for Supervision Michelle Bowman regarding the outlook for U.S. interest rates, in her speech on Friday, indicated that given the still weak labor market, the Fed should be prepared to adjust interest rates to a neutral level.

Due to the potential change in the pace of interest rate cuts, the market expects the interest rate expectation gap to lead to an increase in market interest rates, resulting in a rise in US Treasury yields and a boost to the US dollar.

Summary and Technical Analysis:

Although the United States has recently been embroiled in geopolitical turmoil, the dollar index has been strengthening overall. Whether the geopolitical conflict with Europe will become a turning point for the dollar depends on whether the United States can gain real benefits by initiating geopolitical disputes. If not, the dollar index may resume its downward trend.

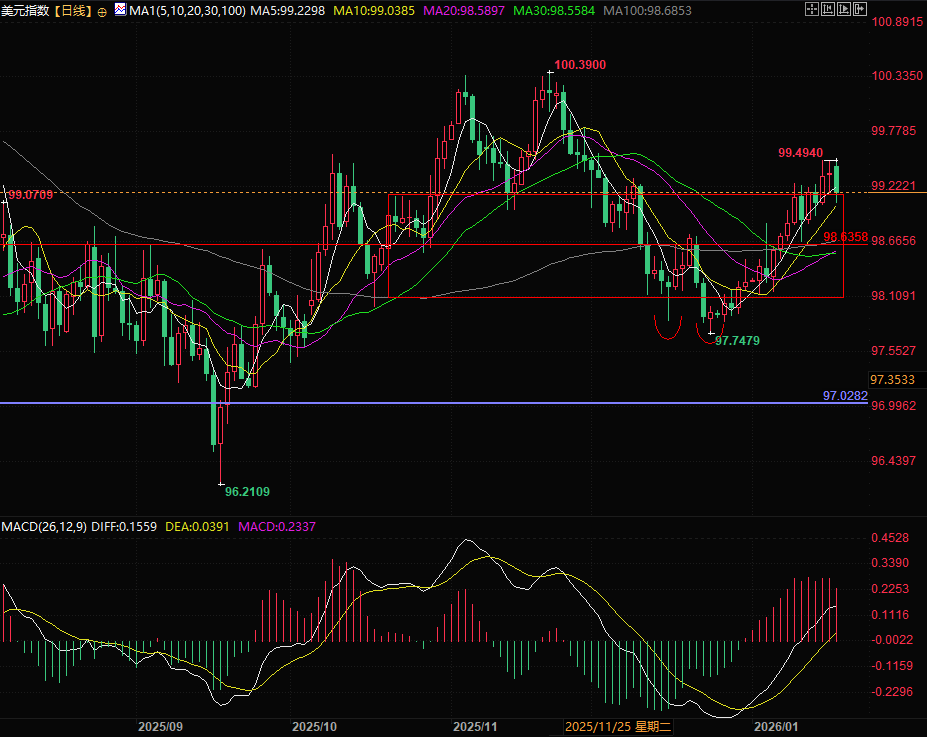

From a technical perspective, if the US dollar index falls below the 5-day moving average, a trend reversal is possible. If it can hold above the 5-day moving average, it has the potential to continue strengthening. Meanwhile, the upward resistance level is at 99.40, and the support levels are around 99.15 and 98.90.

(US Dollar Index Daily Chart, Source: FX678)

At 18:20 Beijing time, the US dollar index is currently at 99.16.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.