US Stocks, Bonds, and Currencies Sell Off, Gold Rally and Trading Tips

2026-01-20 17:50:44

The World Economic Forum's latest "Global Risks Report 2026" highlights that geopolitical risks remain the biggest risk in the past two years. Meanwhile, geopolitical uncertainty continues to escalate. While the easing of the Iranian unrest has reduced the probability of US military intervention, the tensions between the US and Europe triggered by the Greenland dispute have escalated into trade war concerns, further suppressing global investor risk appetite. On the other hand, Russia launched a large-scale drone attack on Ukrainian energy infrastructure on Monday night, followed by a coordinated drone and missile strike on Kyiv early Tuesday morning, directly boosting safe-haven buying and providing solid support for gold.

Meanwhile, the trading side confirmed that the simultaneous decline in US stocks, bonds, and currency often indicates a severe blow to the dollar's credit system, while gold tends to perform well.

Global risk landscape defined: Geoeconomic confrontation becomes long-term support for gold.

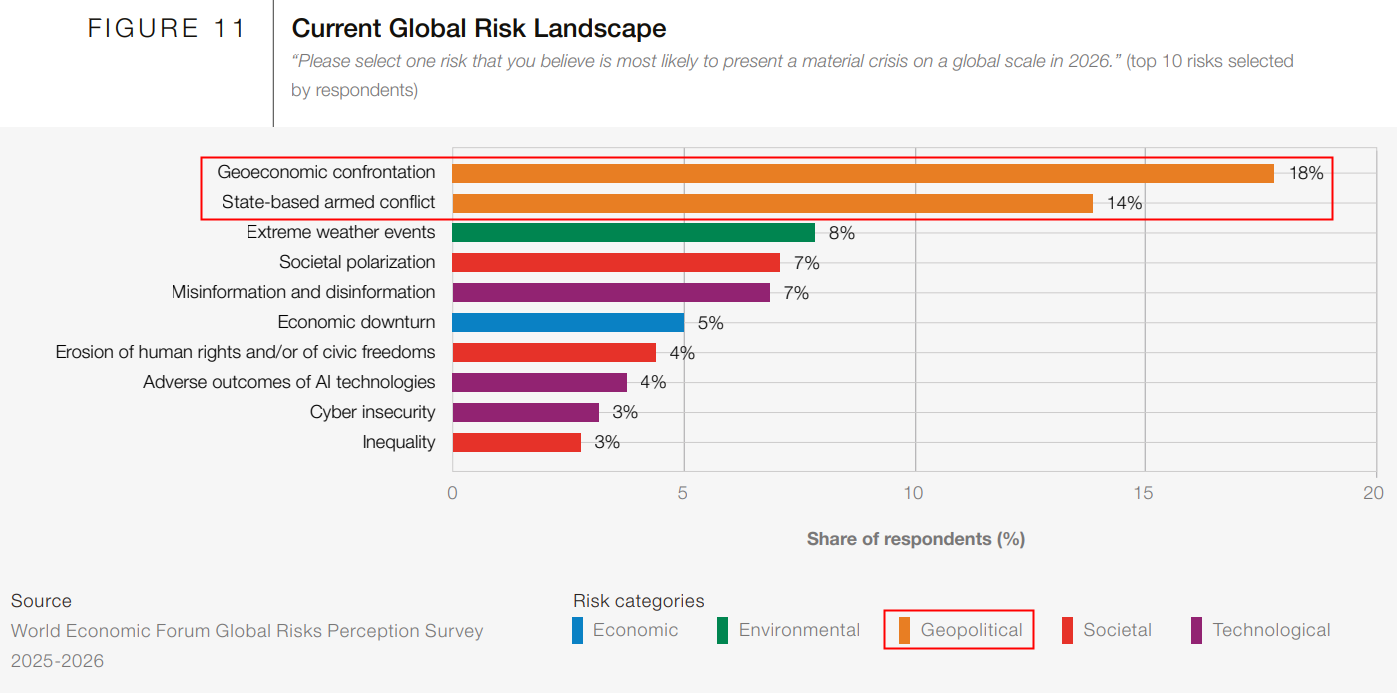

The World Economic Forum's latest "Global Risks Report 2026" lists geoeconomic confrontation as the number one risk of the year, with approximately 50% of respondents expecting the global development environment to be turbulent or prone to storms in the next two years. This risk has risen significantly by eight places from its previous ranking, with 18% of respondents explicitly stating that it could trigger a global crisis in 2026, becoming a core variable affecting global economic stability.

(Ranking of risk factors within 2 years)

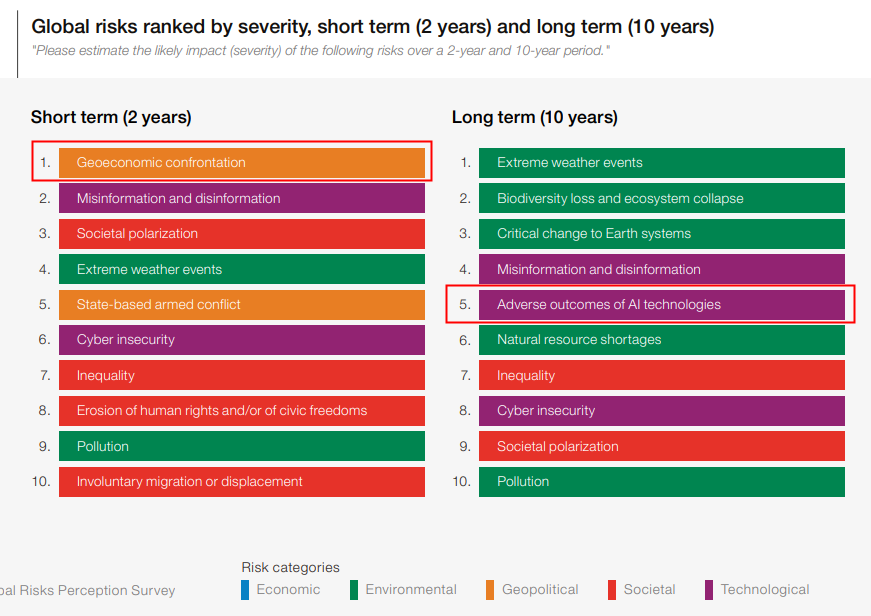

This global risk landscape provides the underlying logic for the long-term rise of gold, a core safe-haven asset. It is worth noting that while AI-related risks do not pose an immediate threat in the short term (ranked 30th in risk ranking for the next two years), their long-term (over the next 10 years) ranking has jumped to 5th, reflecting the market's deep anxiety about technological shocks and adding implicit support to the long-term safe-haven demand for gold.

(2. Ranking of risk factors over 10 years)

US stocks broke down, US Treasuries were sold off and yields hit new highs, and a weaker dollar helped push gold prices to new highs.

The US has recently experienced a triple whammy of stock, bond, and currency declines. Taking advantage of the US holiday, the three major US stock index futures all opened lower and continued to fall in the past two days. The Nasdaq experienced a gap-down breakout, and the yields on US 10-year and 30-year Treasury bonds hit a four-month high. The US dollar index fell by nearly 100 points for two consecutive days.

April 21, 2025: Then-US President Trump publicly criticized the Federal Reserve Chairman, causing market concerns about the central bank's independence and triggering a "triple whammy." On that day, the Dow Jones Industrial Average fell by more than 2%, the US dollar index fell below 98, US Treasury yields rose, while COMEX gold futures surged 3.21%, hitting a record high.

On and after May 19, 2025: International rating agency Moody's downgraded the US sovereign credit rating citing the fiscal deficit, followed by a lukewarm reception to US Treasury auctions, triggering a triple whammy of declines in mid-to-late May. During this period, there was a clear "sell-off of dollar assets" in the market, with funds flowing into gold, pushing gold prices up by more than 2% on that day. Several Wall Street institutions subsequently raised their gold price forecasts, such as Goldman Sachs, which predicted that gold prices could reach $3,700 per ounce by the end of 2025.

Tariff threats trigger sell-off logic; US-EU trade war risks escalate.

Despite the declining probability of the Federal Reserve launching more aggressive monetary easing, US President Donald Trump's tariff threats have completely changed the market landscape.

He made a major announcement over the weekend that if eight European countries obstruct his access to Greenland’s rights, he would impose an additional 10% tariff on goods imported from those countries starting February 1. France has also proposed a series of untested economic retaliatory measures, significantly increasing the risk of a US-EU trade war.

This threat has reignited the trading logic of "selling off US assets." Even though Trump has clearly retained Kevin Hassett as director of the National Economic Council and the market has lowered its expectations for aggressive easing by the Federal Reserve in 2026 (Powell is about to step down, and his successor is yet to be determined), the dollar index has not received a substantial boost. Instead, it has been under downward pressure, which has indirectly amplified the rise in gold prices.

PCE data becomes a key indicator for bullish positions.

Market focus has shifted entirely to the upcoming release of the U.S. core personal consumption expenditures (PCE) price index on Thursday—a key inflation reference for the Federal Reserve's monetary policy decisions, which will directly guide the Fed's interest rate cut path; the final U.S. third-quarter GDP report, to be released at the same time, will also provide important supplementary clues.

Summary and Technical Analysis:

Looking back at recent market developments, concerns about the trade war have consistently been the core driver of demand for gold as a safe haven.

Based on experience, the United States only has two options: either quickly take over Greenland or directly TACO on the spot. US Treasury bonds have already increased yields through their function as a bond police force, which increases the cost of US government debt issuance. This poses a huge threat to the US government's debt issuance. Several presidents, including Clinton, have ultimately changed their political direction due to the high yields of US Treasury bonds.

For gold traders, the first thing to watch is the trend of the US dollar and US Treasury bonds, as they are important indicators of geopolitical risk. If they move in opposite directions, gold is likely to start to fall, meaning a triple whammy of stock, bond, and currency declines could be the extreme point of panic and also the peak for gold. Simultaneously, observe Trump's interactions with Europe in Davos. A turning point for gold may be triggered before February 1st. If gold moves upward before February 1st, it means the impact of US and EU tariffs has been fully priced in. The recent rapid rise in gold prices over the past two trading days could be a response to this February 1st price action.

As for TACO, it means that gold will likely reach a high point after an acceleration in the near future, while US stocks and bonds are more likely to reverse after reaching a low point.

In either case, gold is likely to experience a period of acceleration in the near future, after which the acceleration will be a worthwhile profit-taking point.

From a technical perspective, 4700 is the measured target for this upward move, followed by around 5100. If we consider this to be the acceleration phase mentioned in this article, then this is the high-price zone for gold. However, since the aforementioned positive factors are still developing, gold prices may continue to rise, eventually pulling back to around 4700 after the initial rise. Therefore, as long as gold prices do not break the 5-day moving average and the upward channel, they may continue to rise in line with the trend.

Gold prices have broken through the upper rail of the upward channel, with resistance around 4770 and support at the 5-day moving average and the lower rail of the channel.

(Spot gold daily chart, source: FX678)

At 17:43 Beijing time, spot gold was trading at $4735.62 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.