A chart: The Baltic Dry Index declined slightly, with Capesize freight rates leading the drop.

2026-01-22 23:02:50

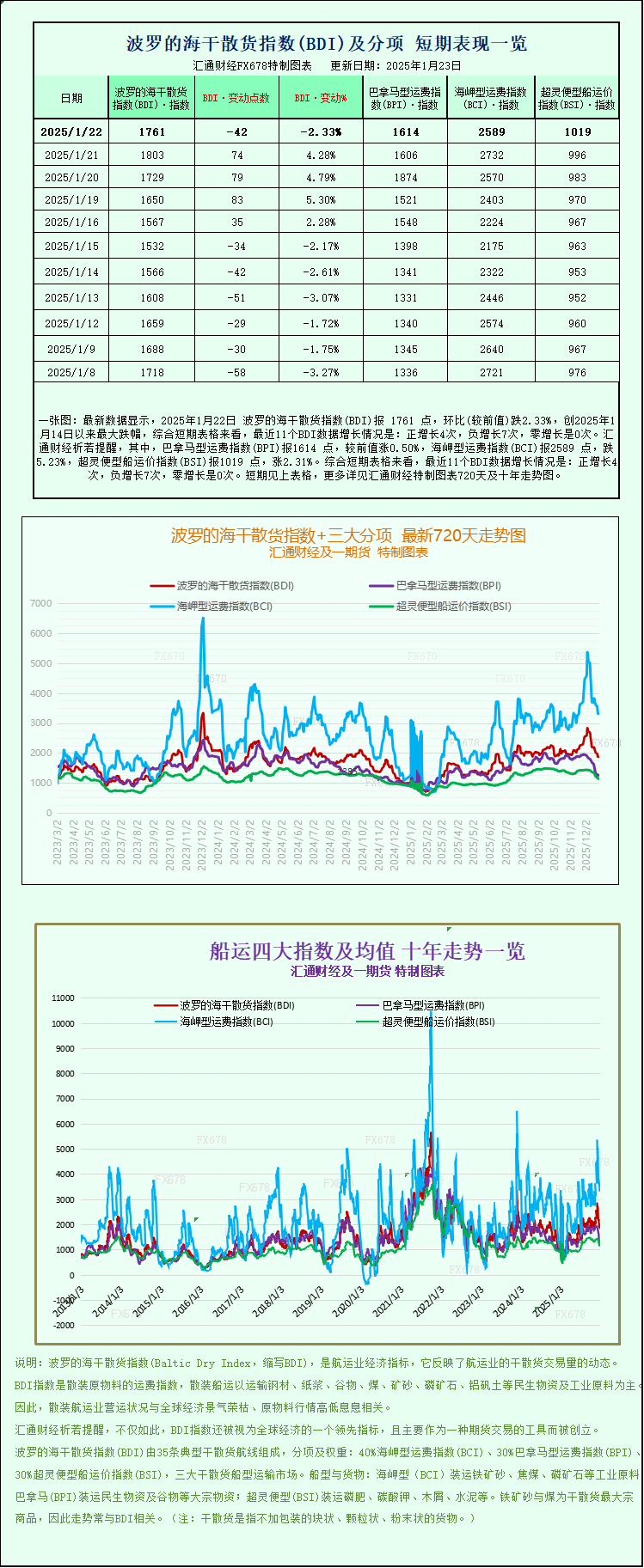

On Thursday (January 22), the Baltic Dry Index (BDI) edged lower during the European trading session, mainly dragged down by declining freight rates for Capesize vessels. The index tracks freight rates for dry bulk carriers, and its fluctuations directly reflect changes in the global dry bulk trade market.

Specifically, the main index covering Capesize, Panamax, and Supramax freight rates fell 42 points, or 2.3%, to close at 1761 points. While this decline is not significant, it broke the recent oscillating trend of the index, highlighting the dominant influence of the Capesize market on the overall index.

The Capesize index, a key drag on the overall index, performed poorly, falling 143 points, or 5.2%, to close at 2589. Capesize vessels, the "giants" of the dry bulk shipping market, primarily handle transoceanic transport of bulk commodities such as iron ore and coal, with a typical cargo capacity of around 150,000 tons per vessel. As a result, the average daily charter rate for Capesize vessels decreased by $1303 to $19976 per day.

Industry analysts believe that the recent decline in freight rates may be related to a temporary slowdown in global iron ore transportation demand, a relatively abundant supply of ships, and the fact that some cargo owners have delayed their ship booking plans, further exacerbating the downward pressure on freight rates.

It is worth noting that iron ore futures, a core cargo transported by Capesize vessels, saw mixed price movements on Thursday. This phenomenon reflects investors' weighing of bullish and bearish factors: on the one hand, Australian mining companies maintained strong shipments, providing ample supply to the market; on the other hand, China's monetary policy support measures boosted market sentiment. The interplay between these two factors led to a divergence in iron ore price trends, which in turn indirectly affected expectations for Capesize vessel demand.

In stark contrast to the sluggish Capesize market, the Panamax market performed steadily. The Panamax index bucked the trend, rising 8 points, or 0.5%, to close at 1614 points. These vessels, with a cargo capacity between 60,000 and 70,000 tons, primarily transport bulk cargoes such as coal and grain. They have a wide route coverage and are relatively less affected by fluctuations in demand for any single cargo type. Correspondingly, the average daily charter rate for Panamax vessels rose by $67 to $14,525 per day, indicating a relatively balanced supply and demand in this segment, with stable demand supporting a slight increase in charter rates.

In the small vessel sector, the Supramax market continued its recovery. The Supramax index rose 23 points to close at 1019, its highest level since January 5. Supramax vessels, with their flexible route adaptability and moderate cargo capacity, hold an advantage in regional bulk cargo transportation. Recently, driven by factors such as the recovery in regional grain transportation demand and faster cargo turnover at smaller ports, freight rates have continued to strengthen, making it one of the few bright spots in the dry bulk market and injecting a positive signal into the overall market.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.