A chart shows the Baltic Dry Index (BDI) declining slightly, dragged down by weaker Capesize freight rates.

2026-02-03 02:12:25

On Monday, the Baltic Dry Index, a key benchmark for the global shipping market, saw a slight decline. The main reason for this weakness was the continued decline in Capesize freight rates. The index mainly reflects the spot market freight rate level of global dry bulk carriers, and its fluctuations directly reflect the supply and demand changes and industry prosperity in the dry bulk shipping market.

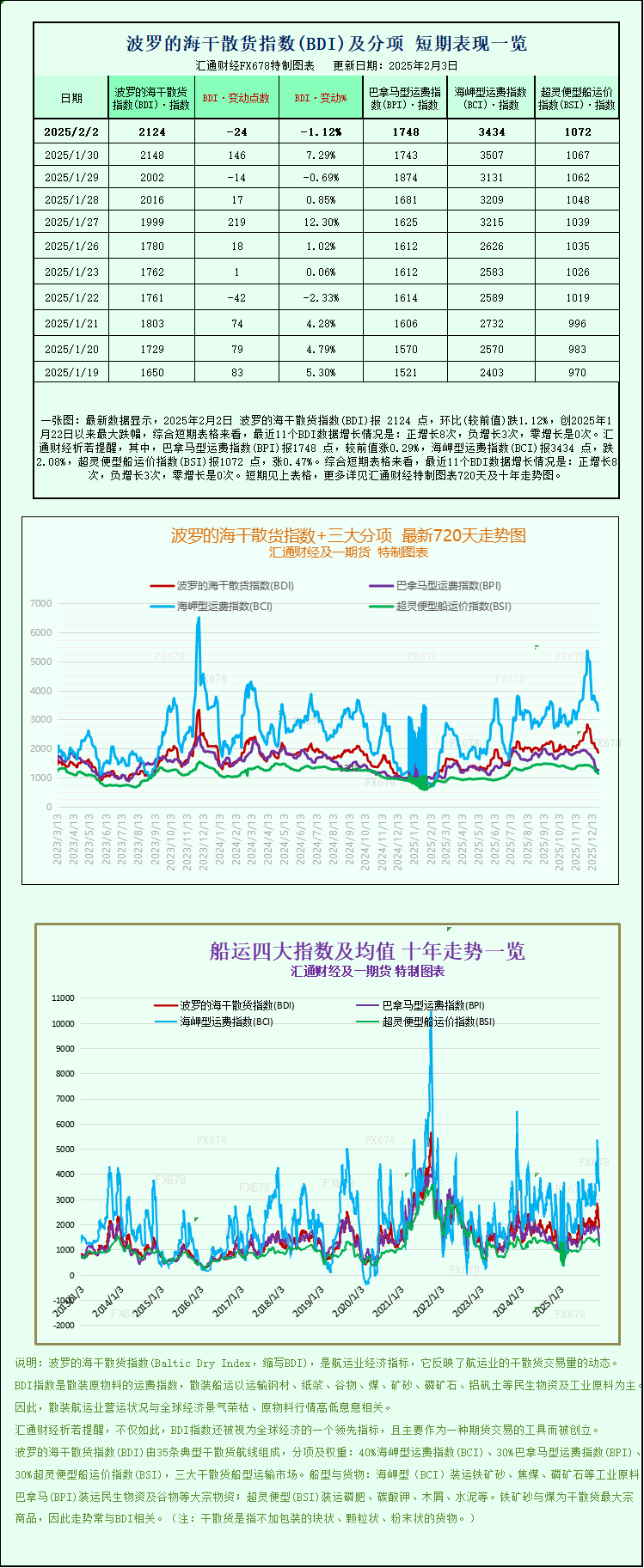

The Baltic Dry Index, which covers freight rates for the three main vessel types—Capesize, Panamax, and Supramax—fell 24 points, or 1.1%, to close at 2124 points, ending its previous short-term consolidation. The index was dragged down by the weakening freight rates for a single vessel type.

The Capesize freight rate index was the main drag on the index's decline, falling sharply by 73 points in a single day, a drop of more than 2%, to close at 3434 points. The continuous weakening of freight rates for this type of vessel also reflects a significant sluggishness in market demand for its corresponding transportation category.

The average daily earnings of Capesize vessels also declined, decreasing by $668 to $27,638 per day. These vessels are the mainstay large ship type in the dry bulk shipping market, typically undertaking the transportation of bulk dry bulk cargo with a deadweight tonnage of 150,000 tons. Iron ore, coal, and other core industrial raw materials are their main transport categories, and their freight rates and profitability are highly correlated with global industrial production and commodity trade.

Iron ore futures prices declined slightly during the same period due to the combined effects of rising iron ore inventories in the Chinese market and the near completion of steel mill restocking cycles. In addition, with the Lunar New Year approaching, domestic demand for related raw materials and spot trading activity entered the off-season. Industry insiders expect that demand and transaction activity in the iron ore market will remain sluggish before the holiday, which is also an important fundamental factor contributing to the weakening of Capesize freight rates.

In contrast to the performance of the Capesize market, the Panamax freight index bucked the trend and rose slightly, gaining 5 points, or 0.3%, to close at 1748 points, demonstrating some resilience against the overall weak market.

Panamax vessels subsequently saw their average daily earnings rebound, increasing by $49 to $15,735. These vessels, with a deadweight tonnage of approximately 60,000 to 70,000 tons, primarily transport commodities such as coal and grain, essential for daily life and industry. Their relatively diverse shipping routes and market demands have made them a highlight of this market trend.

In terms of small-tonnage vessels, the Supramax freight rate index also rose, increasing by 5 points, or 0.5%, to close at 1072 points. The steady increase in freight rates for small-tonnage vessels reflects the relatively stable activity in the region's dry bulk trade, which to some extent offsets the sluggishness of the large-tonnage vessel market.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.