Behind the Bank of England's reluctance to act, the market is already counting down the days to an interest rate cut.

2026-02-05 16:06:17

With the policy dilemma unresolved, maintaining interest rates becomes an inevitable choice.

The Bank of England's decision to keep interest rates unchanged stems from its current predicament.

The UK currently has the highest official financing costs among major developed economies, and its inflation rate of 3.4% in December is the highest among the G7 countries.

Even with weak economic growth and a continued softening labor market, the Bank of England's Monetary Policy Committee (MPC) is hesitant to make any policy adjustments.

James Macht, a fixed-income portfolio manager at SEI, previously stated that the Bank of England must wait for concrete evidence that inflation is falling back toward its 2% target before considering its next move.

The struggle between inflation and wages: internal disagreements within MPC

The struggle between inflation and wage growth makes the Bank of England's policy decisions extremely precarious.

Bank of England Governor Andrew Bailey predicted that inflation could reach the 2% target as early as April or May, thanks to the Chancellor's budget policy and the recent depreciation of the dollar against the pound.

However, policymakers remain wary that one-off factors could mask underlying inflationary pressures, with a key concern being wage growth. A Bank of England survey shows that wage growth expectations remain stable at 3.7%, a level that could push inflation back up at any time, given that the shadow of inflation exceeding 11% in 2022 has not yet dissipated.

However, some data suggests a turnaround, with private sector wage growth potentially falling back to the target level of 3%. This disagreement has led to internal divisions within the MPC, resulting in the December rate cut decision being passed by a narrow margin of 5 to 4.

Facing dual headwinds from the economy and politics, decision-making becomes even more difficult.

To complicate matters further, the dual headwinds of the British economy and politics have further constrained the Bank of England's actions.

The Stammer government is struggling with a weak economic recovery, with the faint signs of recovery among consumers and businesses yet to translate into real growth momentum.

On the political front, the controversy surrounding Starmer's appointment of Peter Mandelson as the UK's ambassador to the US also pushed up the yield on 30-year government bonds and exacerbated market volatility.

The think tank NIESR even predicts that the UK unemployment rate will rise to 5.4% this year, a new high since 2015. The contradiction between weak economy and sticky inflation has led the Bank of England to ultimately choose to "wait and see".

Markets are betting on a delayed rate cut, and a strong dollar is putting downward pressure on the pound.

From a market pricing perspective, traders had previously bet that the Bank of England would not cut interest rates until at least April, or even as late as July, a pace significantly slower than the four rate cuts scheduled for 2025.

Beyond the pound's trading activity, external factors are also exerting influence: during the Asian session, the US dollar index rose slightly by 0.2% to a high of 97.81, briefly touching a two-week high, and the dollar's temporary strengthening put pressure on the pound.

This dollar strength stems from risk aversion in the US stock market – the Nasdaq Composite Index has fallen by 2.9% cumulatively over two days, while Federal Reserve Governor Lisa Cook released hawkish signals, expressing greater concern about a stalled decline in inflation. CME Group data shows that the probability of the Fed keeping interest rates unchanged in March is as high as 90.6%. The dollar's resilience has further compressed the pound's rebound potential.

Summary and Technical Analysis:

For pound traders, now that the decision to keep interest rates unchanged is a done deal, the key focus of the decision lies in the Bank of England's policy wording and subsequent press conference.

If the wording is hawkish, emphasizing sticky inflation and wage risks, it could push up the pound and reverse the current volatile trend; if the wording reveals a stronger dovish tendency or hints at an earlier rate cut, the pound could fall towards the 1.36 level.

In addition, the ECB's interest rate decision at 21:15 on the same day should also be observed – the market also expects the ECB to hold rates steady and its policy statement to emphasize uncertainty. The tone of its decision will also indirectly affect the performance of the pound through the euro's exchange rate against the dollar.

Ultimately, however, the Bank of England's latest assessments of inflation, wages, and the economic outlook are the key to unlocking the mystery of the pound's short-term trajectory.

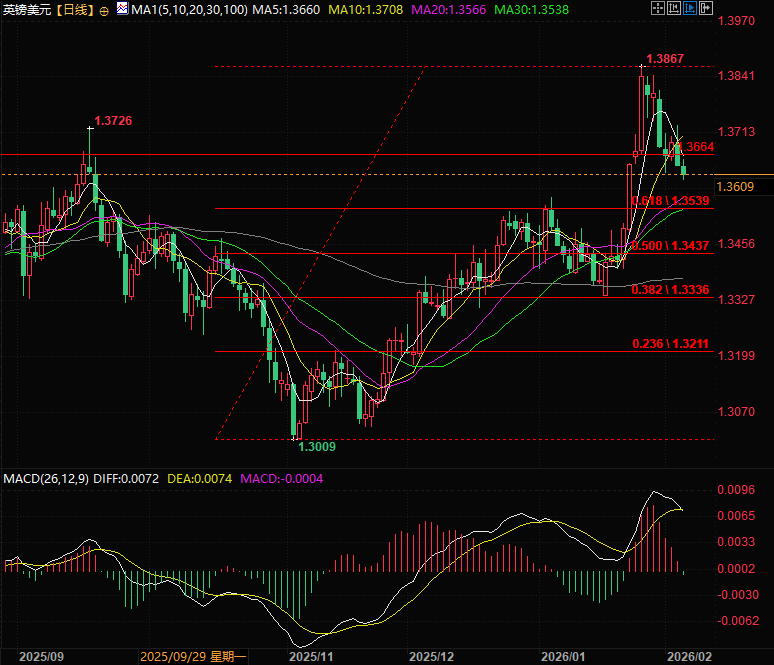

From a technical perspective, the GBP/USD pair failed to hold the strong consolidation level of 0.764 and is currently adjusting towards the 0.618 level. The resistance level is at 1.3664, which is the 0.764 level, while the support levels are around 1.3500 and below that at 1.3539.

(GBP/USD daily chart, source: FX678)

At 15:59 Beijing time, the British pound was trading at 1.3620/21 against the US dollar.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.