Japan Election Preview: Yen Exchange Rate Faces Key Battle; LDP Victory May Increase Intervention Risk

2026-02-06 20:08:43

Currently, the USD/JPY exchange rate has repeatedly approached the 160 mark. Against the backdrop of Japan's economy gradually "returning to normal" and monetary policy slowly normalizing, the yen is at a critical juncture between continuing its current trend and policy intervention.

Political and Policy Background: Stable Expectations Strengthen "High-Market Trading"

Prime Minister Sanae Takaichi's early dissolution of the Diet and call for a general election are primarily aimed at consolidating her ruling base and securing public support. If the Liberal Democratic Party (LDP) achieves a landslide victory as indicated by polls, the market expects a significant reduction in obstacles to its policy implementation.

In the foreign exchange market, such political stability often reinforces so-called "high-market trading"—that is, the market tends to expect more proactive fiscal policy, a slower pace of monetary tightening, and Japan maintaining a low-yield environment in global capital flows. This combination is not favorable for the yen.

The yen exchange rate may see a battle between bulls and bears around the 160 level.

Since the beginning of this year, the USD/JPY exchange rate has experienced significantly increased volatility, and this trend is expected to continue. The core market assessment is that Japan remains in a negative real policy interest rate environment, its fiscal challenges are increasingly prominent, and global investors favor pro-cyclical and high-yield currencies. These factors combined are exerting sustained downward pressure on the yen.

On January 23, the USD/JPY exchange rate fluctuated sharply around the 160 level, leading to initial market suspicions that Japanese authorities had intervened. Subsequent news that the Federal Reserve was conducting interest rate reviews briefly boosted the yen. However, US officials subsequently denied involvement, and related Japanese economic data was also controversial, leading the market to question whether direct intervention had actually taken place.

Regarding the intervention method, the market speculates that some Japanese government-influenced pension funds may provide implicit support for the yen through strategic asset allocation adjustments. This approach is similar to the strategy adopted by South Korea when the won approached the 1500 mark against the US dollar.

If the Liberal Democratic Party (LDP) achieves a landslide victory in this election, related policy expectations may further push up the USD/JPY exchange rate, with the exchange rate potentially testing the 160-162 range again. Japanese officials have repeatedly expressed dissatisfaction with this exchange rate level. While a weaker yen benefits export companies, continued depreciation will drive up the prices of imported goods and weaken the effectiveness of policies, especially given the government's efforts to alleviate cost pressures on people's livelihoods.

Therefore, the market generally believes that Japanese authorities will remain highly vigilant in the 160-162 range and take foreign exchange market intervention measures if necessary.

Why might the effectiveness of intervention be limited?

Historical experience shows that successful exchange rate intervention usually requires two preconditions:

First, the market has seen extreme, one-way speculative positions.

Second, there has been a clear reversal in the macroeconomic fundamentals.

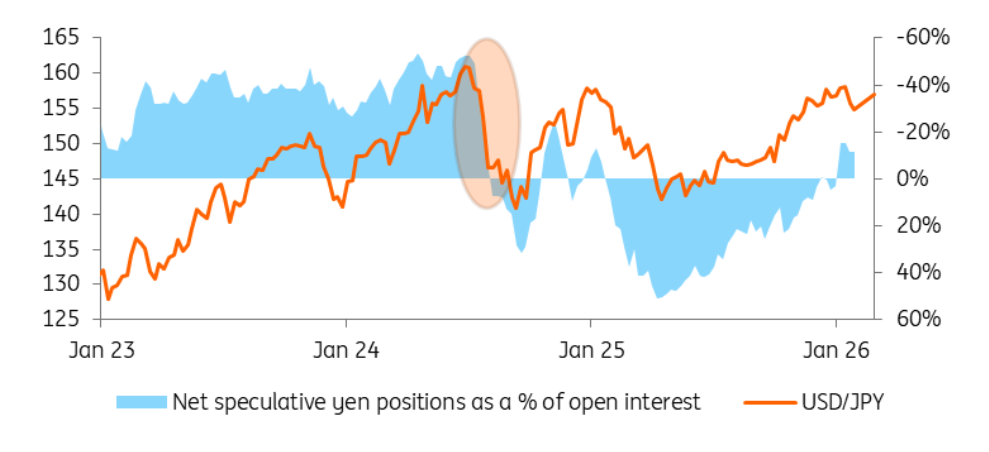

The Japanese authorities' intervention in the foreign exchange market in July 2024 was remarkably effective precisely because speculative short positions in the yen were at extreme levels, and the Federal Reserve was nearing the start of an interest rate cut cycle. In September of the same year, after the Fed cut interest rates by 50 basis points, the dollar/yen exchange rate fell sharply from around 160 to 140 within two months.

(Speculative yen positions are not in a short position as they were in 2024.)

However, the current environment is significantly different. Speculative short positions in the yen are far from the extreme levels seen in 2024, and the Federal Reserve's federal funds rate is approaching the neutral range of 3.75%, limiting further downside potential for short-term US Treasury yields. Against this backdrop, intervention by Japan alone is unlikely to trigger a trend reversal in the USD/JPY exchange rate.

In other words, if the exchange rate rises again, the intervention of the Japanese authorities is more likely to act as a "decelerator" rather than a real reversal.

Exchange rate range forecast for the year: mainly fluctuating, with upside risks remaining.

(USD/JPY daily chart source: EasyForex)

Considering the current political and macroeconomic environment, the market expects that if the poll results are accurate and the Liberal Democratic Party wins the election smoothly, the USD/JPY exchange rate will still face further upside risks in the short term and may repeatedly test the 160 level.

From a time perspective, the USD/JPY exchange rate is likely to fluctuate within the 155-160 range in the first half of this year. If the Federal Reserve cuts interest rates by about 50 basis points as expected this year, the dollar's interest rate advantage will narrow, and the USD/JPY exchange rate may gradually fall back to around 150 by the end of the year. However, within this quarter, the exchange rate still clearly leans towards upside risks.

Furthermore, the funding arrangements for Japan's pledged $550 billion investment in the US are not yet fully clear. Whether the funds will be raised using dollar instruments or involve foreign exchange market operations remains uncertain, adding further uncertainty to the yen's outlook.

Conclusion: The core contradiction of the Japanese yen remains unresolved.

Overall, the Japanese general election seems more likely to reinforce than change the current exchange rate dynamics. Political stability, expectations of fiscal expansion, and the "slow pace" of monetary policy normalization collectively constitute the structural background for the continued pressure on the yen.

Until there is a clear reversal in the fundamentals, the upside potential for the yen will remain limited, while the policy game around the 160 level may become the key focus of the foreign exchange market in the coming months.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.