Gold Trading Alert: A Stunning Reversal! After a nearly 4% surge in a single day, gold recovered the $5,000 mark. What's behind this? A "Dangerous Game" Between the US Dollar and Iran?

2026-02-09 07:54:57

I. Direct Driving Force: The "Resonance Effect" of a Weak Dollar and Geopolitical Concerns

The most direct catalyst for this surge in gold prices came from the "resonance" between the foreign exchange market and geopolitics.

A Brief Respite for the Dollar: The dollar index fell 0.2% on Friday, ending a multi-day winning streak. Although it still recorded gains for the week, this pullback acted as a relief for dollar-denominated gold, making it "cheaper" for investors holding other currencies such as the euro and yen, thus stimulating physical buying and investment demand. This "seesaw" effect is always amplified during periods of heightened sentiment.

A "Hazard-Averse Pulse" Amid the Middle East Fog: Iran's statement that the nuclear negotiations with the United States in Oman had made a "good start" and would continue was intended to ease tensions, but it has generated complex interpretations in financial markets. On the one hand, it temporarily reduces the extreme risk of a direct military conflict; on the other hand, the phrase "will continue" also suggests the protracted and uncertain nature of the negotiations, indicating that they are far from being resolved once and for all.

Market concerns persist that any unforeseen event could shatter the fragile dialogue and reignite regional conflict. This state of "easing but not eliminating concerns" provides sustained, intermittent safe-haven support for gold. The "bottom-fishing behavior of bullish traders," as described by Kitco Metals senior analyst Jim Wyckoff, is precisely emerging from this environment rife with uncertainty.

II. Deeper Game: The Struggle Between Macroeconomic Data, Policy Expectations, and Market Structure

Beyond the apparent driving forces, deeper macroeconomic forces are reshaping the valuation logic of gold.

The Fed's Cautious Stance and Data Confusion: While Fed Vice Chairman Jefferson expressed cautious optimism about the 2026 economy and believed current policies were sufficient to manage risks, San Francisco Fed President Daly painted a different picture—the economy was "walking on thin ice," the labor market was fragile, and further interest rate cuts might be necessary. This subtle divergence in internal signals has further confused the market about the interest rate path. Meanwhile, next week's non-farm payroll report, delayed due to the government shutdown, has become the focus of attention. Previously weak initial jobless claims and job openings data have already led traders to increase their bets on more rate cuts this year. As a non-interest-bearing asset, gold naturally becomes more attractive as expectations of rate cuts rise.

Market Structure: A "Stress Test" Under High Volatility: Another crucial factor behind this rebound is the extremely volatile market environment. The CME Group raised margin requirements for gold and silver futures for the third time in two weeks, directly indicating that market volatility had escalated to a level that alarmed the exchange. Margin increases typically squeeze out some leveraged speculators, leading to a short-term decrease in liquidity and increased price volatility. However, the fact that gold prices rebounded strongly under such pressure precisely demonstrates the existence of solid buying power at lower prices within the market. This resilience under negative pressure is often a signal of an asset's inherent strength.

III. Outlook: A Golden Crossroads – Opportunities and Risks Coexist

Standing before the psychological threshold of $5,000, the road ahead for gold is not without its challenges.

Short-term Momentum and Challenges: Wyckoff points out that the rebound lacks strong momentum, and without new major geopolitical events, it may be difficult to immediately break through previous highs and start a new round of one-sided upward movement. The traditional seasonal bullish phase for gold is also nearing its end, meaning that support from seasonal consumer buying may weaken. In the coming week, the delayed release of US non-farm payroll data and the Consumer Price Index (CPI) will be key indicators. If the data shows a significant deterioration in the job market or a stronger-than-expected decline in inflation, it could significantly strengthen expectations of interest rate cuts, boosting gold prices; conversely, strong data could put downward pressure on gold prices.

Shaping the Medium- to Long-Term Landscape: Analysts believe that if gold prices can consolidate sufficiently within a wide range of $4,500 to $5,500 in the coming weeks or even months, it would be a very healthy trend, accumulating energy for the next round of price movements. This requires the market to digest the current extremely high volatility. Furthermore, the policy speculation sparked by the nomination of former Federal Reserve Governor Warsh as the next chairman will also be a significant long-term factor influencing the dollar and gold. His policy inclinations—how to balance controlling inflation with addressing the precarious economic situation—will redefine the long-term trend of the dollar.

Conclusion: Anchoring Value Amidst the Storms of Uncertainty

Gold's V-shaped reversal last week vividly illustrates its multiple attributes in a complex macroeconomic environment: it is a thermometer of geopolitical risks, a contrarian indicator of dollar confidence, and a bargaining chip in the global liquidity expectation game.

Currently, the market is in a high-frequency volatility pattern driven by data, policy signals, and geopolitical news. For investors, chasing short-term surges and plunges is tantamount to playing with fire. A more rational perspective is to recognize that against the backdrop of lingering deglobalization, policy shifts by major central banks, and the continued brewing of multiple geopolitical hotspots, gold's strategic allocation value as the ultimate safe-haven asset and a hedging tool for the monetary system remains solid.

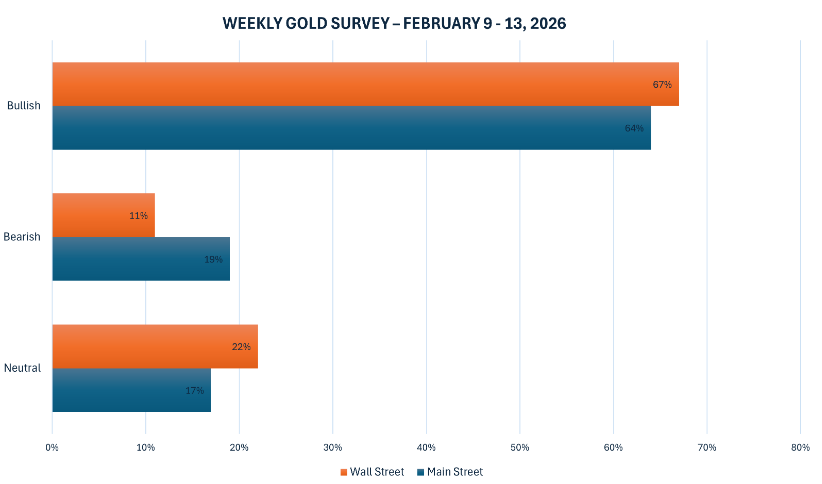

Last week, 18 analysts participated in Kitco News' gold survey, reflecting renewed optimism on Wall Street following a strong rebound in gold prices. Twelve experts, or 67%, were bullish on the outlook, while only two, or 11%, predicted a decline. The remaining four analysts, representing 22% of the total, believed the coming week would see consolidation.

Meanwhile, in Kitco's online poll, 329 votes were cast, indicating a cooling of enthusiasm for gold among Main Street retail investors, but not a complete abandonment. 210 retail traders, or 64%, believe gold will rise in the coming week, while another 62, or 19%, predict a decline. The remaining 57 investors, representing 17% of the total, expect prices to trade sideways in the coming week.

In addition to Wednesday's US non-farm payrolls report and Friday's US CPI data, Tuesday will also see the release of the US retail sales monthly rate, which investors should also pay attention to this week. Furthermore, continued attention should be paid to international geopolitical developments and speeches by Federal Reserve officials.

(Spot gold daily chart, source: FX678)

At 07:51 Beijing time, spot gold was trading at $5040.41 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.