Warning! Major Report: Gold and Silver's Safe-Haven Status Has Vanished, Entering an Era of High Volatility.

2026-02-10 14:47:36

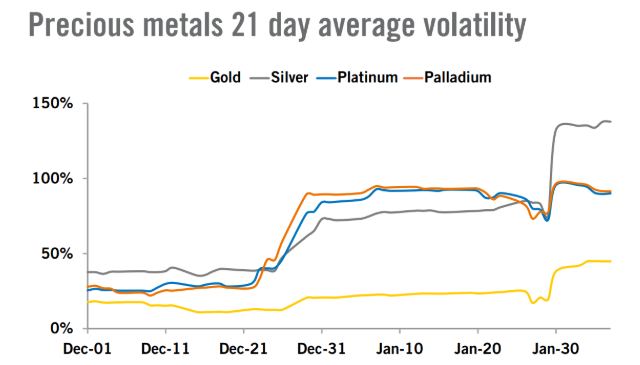

Heraeus precious metals analysts point out that gold and silver no longer exhibit any characteristics of safe-haven assets, but have entered a phase of high volatility—which means the rules of the game have changed for investors.

In their latest market analysis, the team wrote that gold has transformed from a safe-haven asset into a speculative asset .

Analysts stated, "The seeds of this price decline were actually sown during the previously exceptionally strong upward trend—a rare occurrence for a safe-haven asset that should be experiencing low volatility. Gold prices have increased fivefold over the past decade, while the US dollar index remains at 2015 levels. Such a sharp price drop is likely accompanied by factors such as forced liquidation of leveraged positions, triggering of stop-loss orders, and increased margin requirements. Currently, exchanges are continuing to raise margin requirements for futures positions."

Analysts also cited the World Gold Council's "Gold Demand Trends, Q4 2025" report. The report shows that global gold demand will reach 5,000 tons for the first time in 2025. They wrote, "This is primarily driven by a significant increase in investment demand, which completely offsets a decline in demand from jewelry and industrial uses. Central bank gold purchases reached 863 tons, 21% lower than the record high of 1,092 tons in 2024, but still higher than any year before 2022. Fourth-quarter gold demand also hit a record high of 1,345 tons, with investment demand again making up for the weakness in jewelry and industrial demand."

They cautioned investors to prepare for more significant price volatility in the coming weeks and months. Analysts noted, "Gold prices rebounded far more strongly than other precious metals last week, recovering more than 50% of their previous losses, but the momentum faded later in the week. Nevertheless, gold prices remain significantly higher than at the beginning of the year—a level not yet reflected in the price performance of other white metals such as silver."

They added, "Gold is unlikely to reach new highs in the short term, as it will likely take months rather than weeks to dissipate the excessive speculative fervor that previously drove such a rapid and significant rise in gold prices. Gold found support around $4,400 per ounce, a level that may be tested again."

On Monday, gold prices rebounded above $5,000 per ounce. On Tuesday, spot gold fluctuated downwards during the Asian and European sessions, but still remained above $5,000, currently trading around $5,030 per ounce, with a daily decline of about 0.6%.

(Spot gold daily chart, source: FX678)

Regarding silver, Heraeus analysts point out that silver has now clearly entered a phase of high volatility .

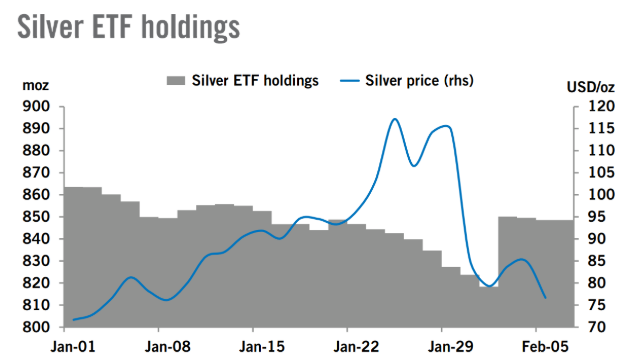

They stated, "Silver initially rebounded after the plunge on January 30, but the rebound momentum reversed midway through the week as retail bargain hunters drove a large influx of funds into silver ETFs. On February 4 alone, ETF holdings increased by nearly 32 million ounces, bringing total holdings back to 850 million ounces."

They added, "Last Thursday's sharp price drop may be related to trading activity in the Chinese market, which appears to be investors reducing positions and cutting losses on any rebounds, or some luckier or quicker-reacting traders choosing to take profits. Both the Shanghai Futures Exchange and the Shanghai Gold Exchange have raised margin requirements."

"After a more dramatic drop in silver prices, the gold-silver ratio has jumped to 64. Just as silver outperformed gold during the previous rally, it has also fallen faster during this correction."

(Spot silver daily chart, source: EasyForex)

On Tuesday, during the Asian and European sessions, spot silver fluctuated downwards and is currently trading around $81.69 per ounce, down about 2% on the day.

At 14:47 Beijing time, spot gold was trading at $5033.14 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.