The yen led the gains, while short sellers swarmed in; tonight's dollar rebound may turn out to be a dead cat bounce.

2026-02-11 18:23:19

Market Review: Negative data and declining Treasury yields pushed the dollar near the 96.50 level.

Looking back at Tuesday's market performance, the US dollar remained resilient against major currencies during the Asian and European sessions, but encountered significant selling pressure during the New York trading session. The benchmark 10-year US Treasury yield fell by more than 1%, breaking below the 4.15% mark and hitting its lowest level since mid-January.

The data came as a negative surprise: the U.S. Commerce Department reported that December retail sales were flat at $735 billion, significantly weaker than the market's expected 0.4% increase, confirming the weakening of consumer support at the end of the year and further solidifying market expectations for a looser Federal Reserve policy.

The US dollar index is currently continuing its slight downward trend, approaching the key level of 96.50. The market expects non-farm payrolls to increase by 70,000 in December, and the unemployment rate is expected to remain stable at 4.4%.

Finally, it should be added that this non-farm payroll data supplement will also include a revised non-farm payroll data for 2025. The U.S. Bureau of Labor Statistics (BLS) releases the Annual Benchmark Revision annually in its January Employment Situation Report (usually released in February).

In September 2025, BLS had already released a "preliminary estimate," which showed a downward revision of 911,000 people. The final figure released this Wednesday is widely expected to remain between 800,000 and 900,000, but some institutions believe the downward revision may exceed 1 million.

Policy game: Internal divisions within the Federal Reserve become apparent, with hawkish statements offsetting expectations of rate cuts.

There is a clear divergence in policy, with two Federal Reserve policymakers speaking out on Tuesday to support maintaining the current interest rate, despite rising market expectations for interest rate cuts, given that inflation remains high.

In her speech, Cleveland Fed President Beth Hammark said that policy rates are likely to remain stable for a longer period of time, and a cautious and patient approach should be taken in assessing the effectiveness of rate cuts and economic performance.

Dallas Fed President Lori Logan pointed out that another rate cut would only be justified if the labor market experiences a further substantial slowdown, and that he is currently more concerned about the risk of persistently high inflation. This hawkish stance, coupled with market expectations of further easing, has exacerbated short-term volatility in the dollar.

Geopolitical risks disrupt the dollar's safe-haven appeal, adding uncertainty and turbulence.

Geopolitical risks have also added uncertainty to the market. According to The Wall Street Journal, US President Trump threatened Iran that if Tehran does not accept its demands on issues such as nuclear enrichment and ballistic missiles, the US may take military action.

Geopolitical tensions typically trigger safe-haven buying, but the US dollar has failed to benefit from this. Instead, it has been under pressure due to economic weakness and continued expectations of interest rate cuts, reflecting a weakening of market confidence in the dollar's safe-haven attributes.

Non-US dollar currency performance: Japanese yen leads the gains, interest rate differentials drive fund flows.

Among non-US dollar currencies, the Japanese yen saw the largest increase among major global currencies, driven by two main factors: first, weaker-than-expected US retail sales data strengthened expectations of a Federal Reserve rate cut; and second, the conclusion of the Japanese House of Representatives election provided additional support for the stability of Japan's long-term government bonds.

BNP Paribas strategist David Forrest points out that weak US economic data has led investors to increase their bets on aggressive interest rate cuts by the Federal Reserve, and interest rate differentials have once again dominated the market. As the G10 currency most sensitive to changes in interest rate differentials, the Japanese yen has naturally become the biggest beneficiary.

(USD/JPY daily chart, source: FX678)

Institutional moves: Hedge funds bet on a weaker dollar, market prices in advance for interest rate cuts.

Institutional fund movements simultaneously reflect a bearish sentiment towards the US dollar. Traders report that hedge funds had already positioned themselves to buy USD/JPY put options before the release of the US non-farm payroll data. If the currency pair continues to decline, the options will appreciate in value. At the same time, they are simultaneously executing a "buy Australian dollar, sell US dollar" trading strategy in the spot market.

From a market pricing perspective, the swap market has already priced in the expectation that the Federal Reserve will implement more than two 25-basis-point rate cuts this year, and this expectation continues to put downward pressure on the dollar index.

Summary and Technical Analysis:

Overall, the US dollar index is currently at a critical juncture where data sensitivity and multiple factors are intertwined. The performance of the January non-farm payroll data and Friday's inflation data will be the core watershed for its subsequent trend. Meanwhile, changes in the Fed's policy stance, geopolitical dynamics, and institutional fund flows will continue to affect the short-term volatility of the US dollar.

The recent rebound in the US dollar has increasingly lacked the signs of a reversal. The market still believes that the White House will be able to influence the Federal Reserve, so the depreciation of the US dollar will be unavoidable. However, it is worth noting that the recent depreciation of the US dollar and the rapid appreciation of the Japanese yen seem to have reflected the negative news in the US in advance. This suggests that regardless of whether the data is good or bad tonight, the US dollar index may reach a temporary low point tonight, but the overall depreciation trend has not changed.

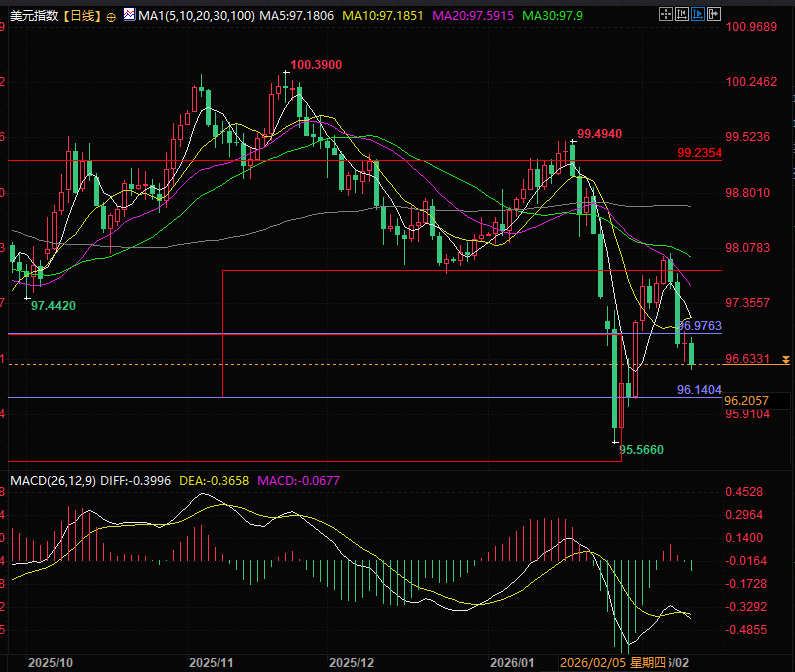

Technically, the MACD formed a golden cross but quickly turned into a death cross. Meanwhile, the US dollar index failed to hold the 97 level, which is also a major neckline for this rebound. Currently, the resistance level is around 96.35, a key starting point for this rebound. If this level is broken, the market will not accept the new Fed chairman's and the US government's so-called strong dollar strategy. The resistance level above is at 97.

(US Dollar Index Daily Chart, Source: FX678)

At 18:19 Beijing time, the US dollar index is currently at 96.57.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.