Non-farm payrolls report triggers a sharp drop, causing a violent sell-off in gold! Wells Fargo calls for 6300.

2026-02-12 17:10:46

The unexpected resilience of the US economy has directly weakened the necessity for a recent interest rate cut. The discrepancy between the US Challenger layoff data and the JOLTS job openings data created a significant difference in expectations. The data release had a significant immediate impact on gold and the US dollar. However, the market subsequently believed that the discrepancy meant that further data was needed to confirm it, and the market is now waiting for the release of important data such as the CPI.

Gold prices continue to fluctuate around geopolitical risks and changes in the cost of capital, namely real interest rates.

Geopolitical easing but uncertainties limit gold price rebound.

Trump stated that Iran is willing to reach a nuclear agreement, and the United States is cautiously optimistic that the US may compromise on the issue of Iran, as Iran has fully demonstrated its sovereignty claims regarding missiles and enriched uranium. Iran has clearly reiterated that the missile issue will not be included in the scope of negotiations at this stage. The Turkish Foreign Minister stated that the lack of compromise between the two sides will only lead to a new war.

The current global geopolitical situation is tense but not out of control, but the US is still considering more severe sanctions such as seizing Iranian oil tankers, which will likely provoke Iranian retaliation.

At the European level, Ukraine is pushing forward with spring elections and preparing for referendums related to a US-led peace framework. Russian airstrikes have once again paralyzed Ukraine's energy facilities, and the EU is also trying to use innovative models to transfer relevant member state rights to Ukraine ahead of schedule.

Global trade competition intensifies and policy uncertainties continue to increase

Global trade developments continue to affect market sentiment. The White House quietly revised the explanatory document for the US-India trade agreement, downgrading the wording of India's $500 billion US import plan from "commitment" to "intention." While seemingly a minor textual adjustment, this actually signals a key policy shift. The document also removed the relevant clauses on tariff preferences for soybean products.

U.S. Treasury Secretary Bessenter characterized the U.S.-China relationship as "stable and competitive," emphasizing that both sides are focused on risk mitigation rather than a complete decoupling.

The White House continues to speak out on the dispute over the US-Canada bridge, with Trump insisting that the US should hold at least 50% of the project.

Non-farm payroll data release leads to strong expectation gap and amplified instantaneous reaction.

US non-farm payroll data is the core theme of market trading. Before the release, economists, taking into account the recent decline in core retail sales and the possibility of a significant downward revision of employment data, expect non-farm payrolls to increase by 70,000 in January, compared to only 50,000 in December. They also expect the unemployment rate to remain at 4.4%, and the rate of wage growth to slow down. At the same time, they expect the revised figure for actual US job growth in 2025 to be 911,000 fewer than the initial figure.

After the actual data was released, the US added 130,000 non-farm jobs in January, significantly exceeding the market expectation of 70,000. The unemployment rate even fell slightly to 4.3%, indicating that the US labor market is resilient, short-term energy demand has solid support, and wage growth has not slowed down, exceeding the expectation of 3.6% to 3.7%. The downward revision of the number of jobs in 2025 is only 825,000.

It is worth noting that although the data was generally unfavorable to gold, it did not bring excessive selling pressure to gold. On the contrary, it seemed to solidify the bottom of the recent rebound in gold.

US Treasury yields and a pullback in the dollar provided an environment for a rebound in precious metals.

Following the release of US data, US Treasury yields and the US dollar index surged collectively due to decreased expectations of interest rate cuts. The yields on 2-year and 5-year Treasury bonds rose by more than 2% at one point, and the yield on 10-year Treasury bonds rose by more than 1.5%. However, the upward momentum did not last long, and the overall trend eventually reversed after reaching a high. The US dollar index continued its weak and volatile movement.

The dollar remains at a two-week low and US Treasury yields have retreated sharply, reducing the opportunity cost of holding non-interest-bearing assets like gold.

The depreciation of the US dollar has reduced the cost for overseas investors to buy dollar-denominated gold and silver. At the same time, lower bond yields have compressed the returns on fixed-income assets, further enhancing the cost-effectiveness of precious metals and directly boosting demand for precious metals.

Analyst's View: Interest Rate Cut Cycle Benefits Precious Metals Trends

The CME FedWatch Tool shows that traders are pricing in at least two 25-basis-point rate cuts in 2026, with no change in their expectations. Despite recent price volatility, institutions remain optimistic about gold, with Wells Fargo Investment Institute raising its year-end 2026 target to $6,100 to $6,300 per ounce, anticipating lower short-term interest rates and continued central bank purchases.

JPMorgan Chase projects year-end production at $6,300 per ounce, primarily driven by reserve diversification. UBS and Deutsche Bank forecast prices at around $6,200 per ounce, emphasizing the continued impact of geopolitical issues and demand for physical assets.

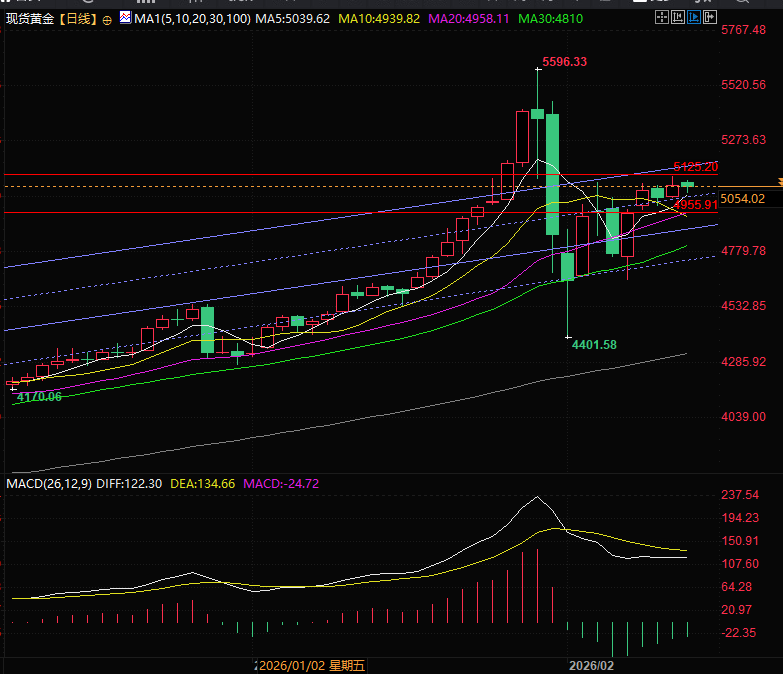

(Spot gold daily chart, source: FX678)

At 17:08 Beijing time, spot gold was trading at $5,057 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.