JPMorgan Chase: Gold price rally is not without merit, but the reasons for a bearish outlook are difficult to substantiate.

2026-02-18 18:50:03

I. Why did gold prices surge? A combination of geopolitical and monetary uncertainties.

Kriti Gupta, managing director of JPMorgan Private Bank, and Justin Biemann, global investment strategist, pointed out that the sharp rise in gold prices over the past few years is closely related to the arrival of the "era of geopolitical fragmentation."

Since the outbreak of the Russia-Ukraine conflict, global political risks have risen significantly, discussions about the safety of dollar assets have intensified, and some countries have begun to reassess their reserve structures. At the same time, the market is also burdened by concerns about currency devaluation, widening fiscal deficits, slowing economic growth, and inflation risks.

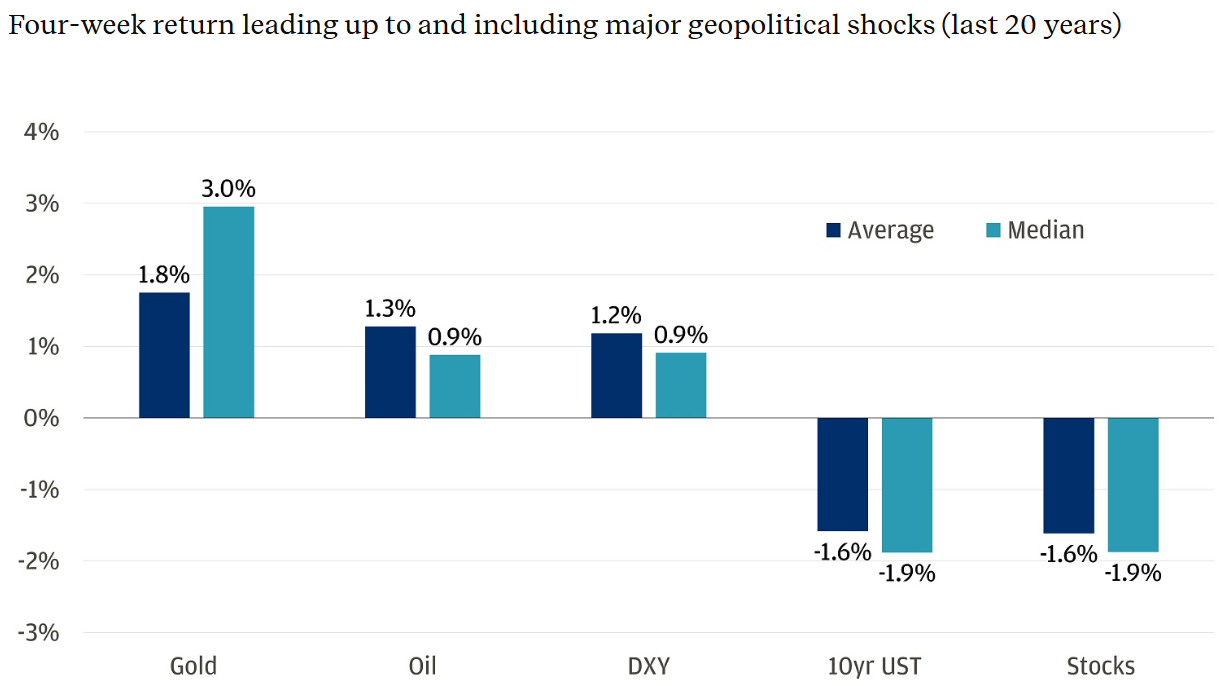

During periods of significant geopolitical shock, gold's average return is approximately 1.8%, with a median return of 3.0%, outperforming most traditional asset classes. This "safe haven during times of stress" characteristic makes it an important defensive tool in asset allocation.

(Returns over the past 20 years in the four weeks preceding and including the period of a major geopolitical shock - Average - Median: Gold: Average 1.8%, Median 3.0%; Crude Oil: Average 1.3%, Median 0.9%; US Dollar Index: Average 1.2%, Median 0.9%; 10-Year US Treasury Yield: Average -1.6%, Median -1.9%; Stocks: Average -1.6%, Median -1.9%)

The question then arises: if geopolitical conflicts are unlikely to ease in the short term, what could prevent gold prices from continuing to rise?

Second, one of the risks: Will the central bank's demand cool down?

JPMorgan Chase believes the first potential risk comes from central banks around the world.

Since the Russia-Ukraine conflict began in 2022, global central bank net gold purchases have more than doubled. The US move to freeze Russian assets has prompted some countries to accelerate reserve diversification and reduce their dependence on the US dollar.

Currently, excluding the International Monetary Fund (IMF), the five countries with the largest gold reserves globally are the United States, Germany, Italy, France, and Russia. If central bank demand slows down in the future, or even turns into net selling, it will theoretically impact gold prices.

This is not unprecedented in history. Between 1999 and 2002, the British government auctioned off its gold reserves on a large scale, and Switzerland also decoupled the Swiss franc from gold. Within three months of the UK announcing its sale plan, gold prices fell by approximately 13%. Subsequently, many central banks signed the Washington Gold Accord to coordinate and limit large-scale sales. This agreement expired in 2019, and central banks have since become net buyers overall.

However, JPMorgan Chase believes that the possibility of a large-scale sell-off by the central bank in the short term is extremely low.

As of 2025, gold reserves in emerging markets accounted for approximately 19% of total reserves, far lower than the approximately 47% in developed markets. Taking China as an example, although it is already one of the world's major gold reserve holders, gold only accounts for about 8.6% of its foreign exchange reserves, indicating room for further growth.

In addition, countries such as Poland, India, and Brazil have also been continuously increasing their gold reserves in recent years. Surveys show that 95% of central banks expect global gold reserves to continue to increase by 2025, with no respondents anticipating a decline.

Even for the Federal Reserve, selling gold would require a major legislative process and would break with more than a century of institutional conventions, making it extremely impractical.

Third, the second risk: Will retail investors' funds be withdrawn?

The second risk comes from retail investors.

(Global gold ETF holdings, unit: millions of ounces, data as of February 12, 2026)

Amid escalating geopolitical risks and macroeconomic uncertainties, retail investors continue to flow into gold ETFs. However, market concerns exist that these funds could quickly withdraw once risk sentiment eases or alternative hedging tools emerge.

In late January of this year, gold prices rose by 20% in a week, only to give back the same amount of gains within two days, showing that short-term funds do indeed amplify volatility.

However, from a long-term perspective, retail participation has not yet reached historical extremes. Currently, global gold ETF holdings are approximately 100 million ounces, equivalent to only about 8% of global central bank gold holdings. This figure is still lower than the record of approximately 110 million ounces set in 2020.

JPMorgan Chase believes that while retail investor spending exacerbates short-term volatility, it is not enough to dominate long-term pricing trends.

IV. The long-term logic remains: the value of allocation has not been exhausted.

From an asset allocation perspective, gold is not only a short-term safe-haven asset, but also one of the core assets for long-term risk diversification.

Its advantages are mainly reflected in three aspects:

First, gold serves as a hedge against inflation and currency devaluation in the long term. When fiscal deficits widen, money supply growth accelerates, or real interest rates decline, the purchasing power of fiat currency is often eroded. As a scarce asset, gold's intrinsic value does not depend on any sovereign credit system, and therefore it is often regarded as an important tool for hedging currency credit risk.

Secondly, during periods of sharp fluctuations in financial markets or rising systemic risks, gold often exhibits relative resilience and may even rise against the trend. Whether it's geopolitical conflicts, financial crises, or liquidity shocks, gold typically serves as a "safe-haven asset," providing a buffer for investment portfolios.

Secondly, from an asset allocation perspective, gold has a generally low correlation with traditional assets such as stocks and bonds. This low correlation means that when other asset prices experience a synchronized pullback, gold may not move in the same direction, thus helping to smooth the overall portfolio return curve and reduce the overall volatility of the portfolio.

Natasha Kaneva, global head of commodities strategy at JPMorgan Chase, previously pointed out that the "repricing" trend in gold prices is not yet over. The entry of Chinese insurance funds and the allocation of gold by some cryptocurrency investors could generate new demand in 2026.

The bank projects that global central bank gold purchases will remain robust in 2026, averaging approximately 585 tons per quarter. Meanwhile, a weaker dollar, declining US interest rates, and ongoing economic and geopolitical uncertainties are all traditionally bullish factors for gold.

In the current environment, gold serves as both a hedge against currency devaluation and, to some extent, a "non-yielding asset" competing with US Treasury bonds and money market funds.

V. Conclusion: The upward trend may be non-linear, but the trend is not yet over.

In summary, JPMorgan Chase did not deny the existence of volatility risks in gold, and acknowledged that central bank and retail investor behavior are key variables. However, considering the rebalancing of reserve structures, continued official demand, and the trend of asset diversification, the structural support for gold has not yet been exhausted.

In other words, the rise in gold prices may not be smooth sailing, but the core logic for a bearish outlook at the current stage still seems to lack sufficient evidence.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.