The US dollar and gold rose simultaneously in a rare manner. Is gold's momentum at full strength or just the last gasp?

2026-02-19 19:35:10

Escalating geopolitical risks: the core driver of safe-haven buying in gold

Geopolitical risks are undoubtedly the core driver of this round of gold price increases. The US military deployment around Iran continues to escalate, and there are reports that the US military may launch an attack on Iran as early as Saturday. The Pentagon has planned to evacuate some personnel from the Middle East within the next three days to Europe or the US mainland in preparation for potential conflict or Iranian retaliation.

Despite White House Press Secretary Carolyn Levitt's statement that the US-Iran negotiations had made "some progress," the two sides remained "far apart" on key issues, and the Trump administration did not explicitly rule out military options. This ambiguous situation, characterized by "progress in negotiations and the risk of conflict," further fueled the market's risk aversion premium.

Meanwhile, although procedural progress has been made in the Russia-Ukraine negotiations, the United States continues to sell weapons to its NATO allies, and the uncertainty of the geopolitical situation has not been fundamentally eliminated.

With multiple geopolitical risks overlapping, the market has begun to price in contingency scenarios in advance, and gold, as a traditional safe-haven asset, is showing typical characteristics of net inflows of safe-haven funds.

Meanwhile, oil prices climbed to multi-week highs, further reinforcing the logic of gold as an inflation hedge.

It is worth noting that the current market has once again seen a unique pattern of simultaneous rises in stock and gold prices: the multi-year AI chip collaboration between Nvidia and Metaverse platform company has provided underlying support for US economic growth, prompting investors to increase their gold holdings to hedge against geopolitical shocks while maintaining exposure to technology and growth sectors. This has continued the recent unique trend of "dual-track deployment of risk assets and safe-haven assets," and has also led to the phenomenon of technology stocks and precious metals rising and falling together for a period of time.

Subtle shifts in monetary policy: Inflation resilience supports gold valuations

The adjustment in monetary policy has provided another core support for gold. The minutes of the Fed's January meeting made it clear that policymakers were extremely unlikely to cut interest rates in the near term. CME's FedWatch tool showed that the probability of a rate cut in March was only 5.9%, while the probability of keeping rates unchanged was as high as 94.1%. This statement reflects both confidence in the resilience of the US economy and suggests that inflation remains a key concern.

More noteworthy is the interpretation by Nick Timuraos, the "Federal Reserve mouthpiece": the January minutes removed the explicit statement from December that "inflation will return to 2% by 2028," and instead emphasized that inflation forecasts would "rise slightly and remain balanced," only expecting inflation to return to a downward trend after the impact of tariffs ends.

This ambiguity in the timeline for the inflation target has exacerbated market concerns about the resilience of long-term inflation. While gold's anti-inflationary properties perfectly match investors' hedging needs, inflation lowering the Fed's expectations for interest rate cuts directly negatively impacts gold, and the negative impact outweighs the upward pressure from inflation on gold.

Although the high-interest-rate environment puts short-term pressure on gold, a non-interest-bearing asset, the combination of inflation stickiness and policy uncertainty makes gold a high-quality target for hedging against interest rate volatility. Compared with interest rate-sensitive assets such as high-growth technology stocks, gold's volatility resilience is more prominent.

Structural market divergence: Gold and dollar rising in tandem suggests strong buying interest in gold.

Influenced by the Federal Reserve meeting minutes, concerns about domestic inflation in the United States intensified, and the US dollar index also rebounded strongly on Wednesday. However, strangely, gold did not fall in the opposite direction. Instead, there was a strange phenomenon that the dollar and gold rose together. This indicates that the demand for dollar-denominated gold increased when the price rose, representing that the recent increase in gold demand driven by geopolitical situation ignored the price increase.

Tech optimism has improved market risk appetite, while geopolitical caution provides reasons to buy, which is also fueling this rebound in precious metals.

The technology sector has seen a localized bull market catalyzed by the positive impact of the AI industry, but macroeconomic risks such as tensions in the Middle East, oil price volatility, and a slower-than-expected decline in inflation have limited the expansion of overall risk exposure. This situation further highlights the hedging value of gold.

In the short term, the market's sensitivity to geopolitics will remain high: if a real conflict breaks out between the US and Iran, gold prices are expected to hit $5,100/ounce or even higher targets; if negotiations make a breakthrough, the fading geopolitical premium may trigger a pullback in gold prices to the $4,900/ounce support level.

Looking at real-time market data, as of February 19, spot gold in London was trading at $4,992.24 per ounce, remaining at a high level and indicating that the market has not yet fully priced in geopolitical risks.

Summary and Technical Analysis:

The recent rebound in AI has boosted risk appetite, coupled with unresolved geopolitical issues and the atmosphere of a large-scale US military buildup, which continues to drive a rebound in gold and other precious metals.

The recent simultaneous rise in crude oil prices reflects the market's optimistic speculation on geopolitical pricing. However, if geopolitical developments fall short of market expectations, or if a black swan event occurs in AI, there could be a double pressure from a contraction in risk appetite coupled with a relaxation of geopolitical tensions. Investors need to manage their risks carefully.

In the medium to long term, the structural demand for gold purchases by global central banks and the process of "de-dollarization" provide solid bottom support for gold. It still has long-term allocation value below $5,000/ounce. Investors can add positions in batches when the price pulls back to the $4,700-$4,800/ounce range to lock in long-term returns.

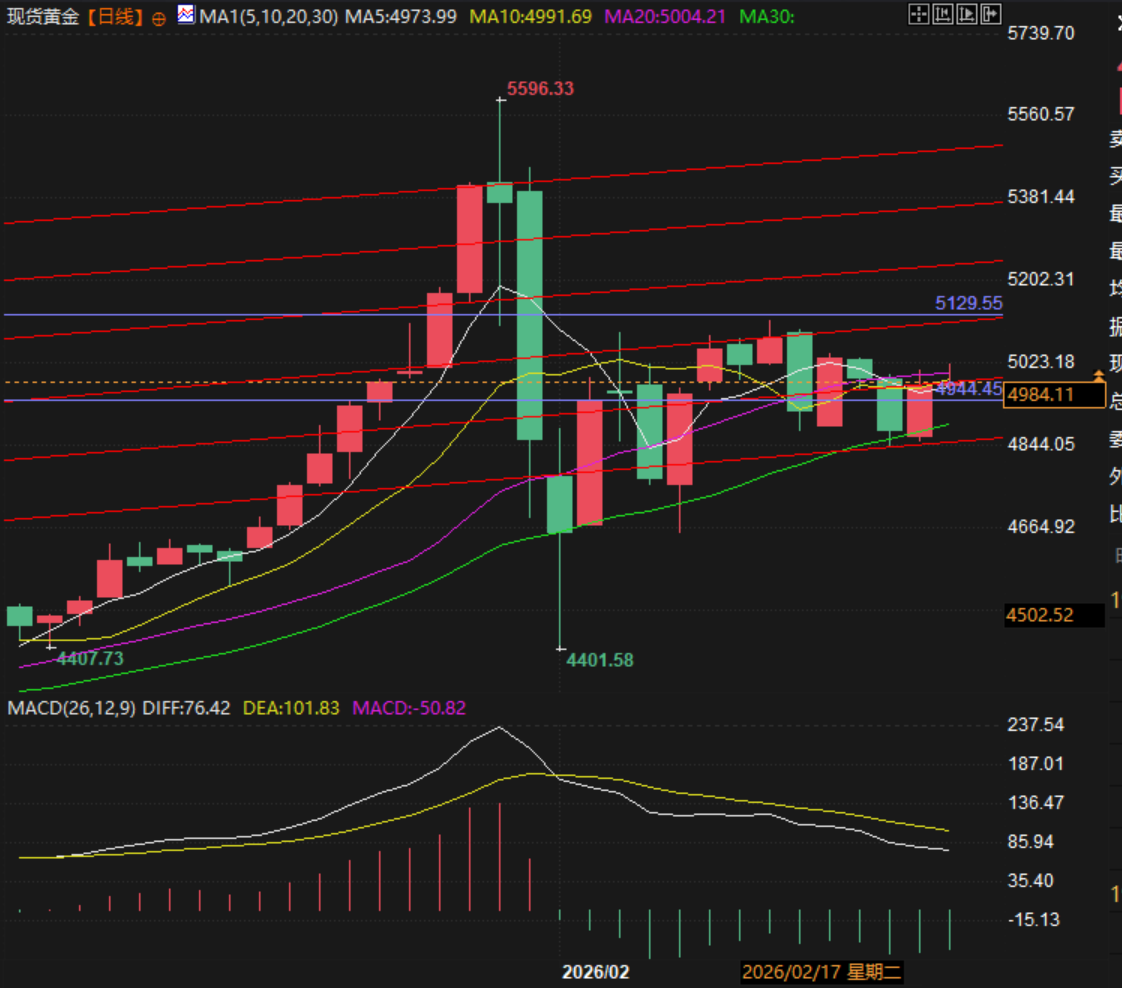

From a technical perspective, spot gold has rebounded to 4944. Although it was suppressed by the channel, it still recovered the key level of 4944, and the rebound is expected to continue.

(Spot gold daily chart, source: FX678)

At 19:33 Beijing time, spot gold was trading at $4,985 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.