A chart shows the Baltic Dry Index (BDI) falling for the third consecutive day to a one-week low, with Capesize and Supramax freight rates being the main drags.

2026-02-19 22:47:47

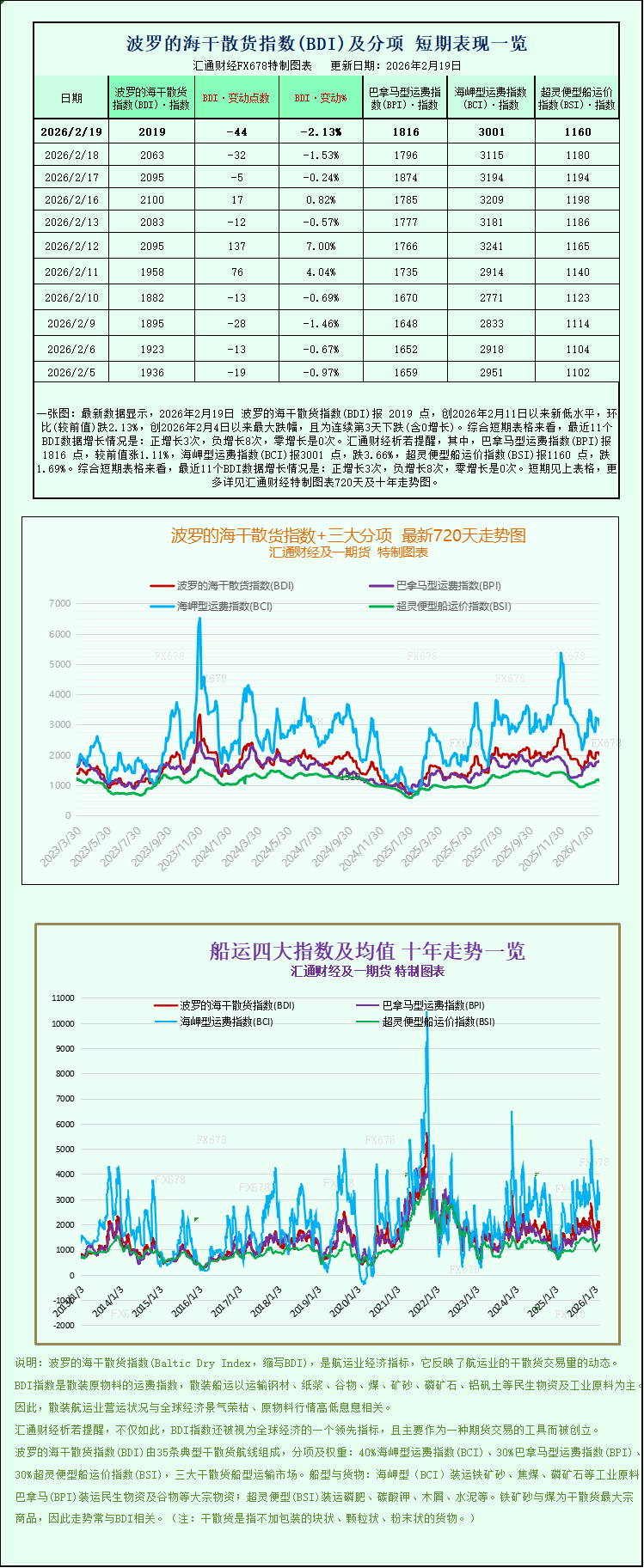

On Thursday, February 19, 2026, the Baltic Dry Index (BDI), a key indicator of the international dry bulk shipping market, continued its downward trend, marking its third consecutive day of decline. Directly dragged down by weak demand and persistently low freight rates for both Capesize and Supramax vessels, the index ultimately hit its lowest level in a week. As a "barometer" of the global dry bulk shipping market, the BDI directly reflects the activity in the maritime transport market for commodities such as iron ore, coal, and grains. Its three consecutive declines reflect the current localized weakness in the dry bulk shipping market.

The Baltic Dry Index (BDI), a comprehensive index that tracks freight rate changes across the three major dry bulk carrier types—Capesize, Panamax, and Supramax—saw a significant drop on the day, falling 44 points, or 2.1%, to close at 2019 points. This figure represents the lowest level since February 11, indicating that overall freight rates in the dry bulk shipping market have fallen to recent lows within a week.

Among the three major ship types, Capesize vessels were the biggest drag on the index decline. The Capesize freight rate index plummeted 114 points, a drop of 3.7%, ultimately closing at 3001 points. Capesize vessels are ultra-large vessels in the dry bulk shipping sector, primarily responsible for the long-distance transport of basic industrial commodities such as iron ore and coal globally. A single vessel can carry up to 150,000 tons of cargo, and their freight rates are highly correlated with the raw material demand of the global steel and power industries. Affected by the sharp drop in freight rates, the average daily earnings of Capesize vessel owners also shrank, decreasing by $1034 in a single day to $23713, significantly impacting the operating income of ship owners.

In stark contrast to the sluggish performance of Capesize vessels, Panamax vessels emerged as one of the few bright spots in the dry bulk shipping market that day. The Panamax freight rate index defied the trend, rising 20 points, or 1.1%, to close at 1816 points. Panamax vessels carry cargo in the range of 60,000 to 70,000 tons, primarily transporting commodities such as coal and grain—essentially essential commodities for daily life and industry. Their routes are mostly concentrated within regional and near-sea areas, and supported by regional market demand, freight rates for this vessel type have steadily increased. Correspondingly, the average daily earnings of Panamax vessels also rose, increasing by $173 in a single day to reach $16,340, making it the only vessel type in the Baltic Dry Index to achieve earnings growth that day.

Besides Capesize vessels, Supramax vessels, a type of small dry bulk carrier, also significantly dragged down the overall index. The Supramax freight rate index failed to maintain its previous oscillating trend, experiencing a significant decline of 20 points, or 1.7%, to close at 1160 points. Supramax vessels, with their flexible loading and unloading and route advantages, primarily handle small to medium-volume dry bulk cargo. Their weakening freight rates reflect a decline in demand for transporting small to medium-volume bulk commodities, further exacerbating the downward pressure on the Baltic Dry Index.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.