The "perfect pricing" collapsed overnight! The Federal Reserve extinguished the "rate-cutting frenzy," and the last line of defense for bond market bulls turned out to be this number...

2025-10-30 20:52:23

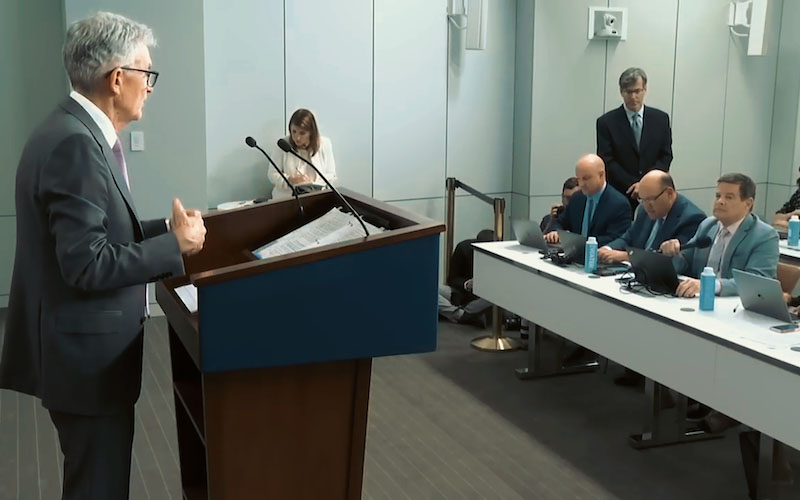

Federal Reserve Chairman Jerome Powell emphasized at the press conference that a December rate cut is not a done deal, and the decision will heavily depend on subsequent data. This statement contrasts with the slightly dovish bias in the September dot plot, reflecting continued disagreement within the Fed regarding further rate cuts. Despite resilient consumption, concerns about a slowing job market have prompted a shift in policy stance towards a more cautious "risk management" model. Market expectations for a December rate cut have fallen from nearly 90% before the meeting to about 60%, indicating a significant cooling of sentiment.

On the other hand, quantitative tightening (QT) will end on December 1st, at which time the Federal Reserve will reinvest in Treasury bills through the SOMA portfolio to match the maturity structure of its balance sheet and U.S. Treasury bonds. Although this shift is considered a neutral operation, it is expected to alleviate short-term funding pressures as the timing is close to a period of tightening liquidity in the repo market, while also providing some support for long-term yields.

Fundamental expectations recalibrated

The Federal Reserve's cautious signals have quickly reshaped the logic of the bond market. Powell explicitly stated that the decision-making process does not pre-determine a path, aiming to curb excessive optimism in the market previously fueled by expectations of interest rate cuts. Current economic data signals are mixed: consumer spending is robust, but the job market is showing signs of weakness, prompting the Fed to adopt a more conservative policy stance.

The adjustment of reinvestment policy further reinforces this logic. After the QT ends, the Federal Reserve will maintain the size of its balance sheet and reinvest the proceeds from maturing MBS into Treasury bills to shorten asset duration and better align with the overall maturity structure of US Treasury bonds. Currently, Treasury bills and short-term bonds account for only 18% of the outstanding US Treasury bonds, while such assets account for only 3% of SOMA holdings. Therefore, the rebalancing process is expected to primarily boost front-end demand, with limited impact on long-term pricing. Powell pointed out that this process will be gradual and will not immediately trigger market volatility, but close monitoring of changes in banking system liquidity is necessary.

External factors also contribute to uncertainty. While the repercussions of tariff rhetoric have gradually subsided, they still linger and affect expectations for third-quarter growth. The market has already lowered its Q3 GDP growth forecast to 3.0% (annualized), down from 3.8% in Q2. Furthermore, the data release delays caused by the government shutdown have led the market to rely on estimates in the absence of clear signals. If continuing unemployment claims rise as expected, it could further reinforce the Federal Reserve's wait-and-see stance.

The <H2> yield curve shows double-bottom support.

The changes in the yield curve have become the core reflection of this round of adjustments. The spread between the 5-year and 30-year yields formed a double bottom after hitting 92 basis points, a level that now constitutes key support. The 5-year yield has rebounded from its low of 3.50% on October 17 to 3.727%, approaching its previous high of 3.78%; the 30-year yield has also recovered from its low of 4.52% to 4.65%, nearing the resistance level of 4.675%. The increasing pressure to flatten the yield curve indicates that the longer term is more sensitive to policy tightening.

The Federal Reserve's reinvestment policy is shifting towards earlier-stage adjustments, which is expected to further compress interest rate spreads. Trading activity shows that although buying in the London session briefly pushed the 10-year yield down to 4.058%, sellers quickly retaliated in the US session, reflecting that a "sell the fact" sentiment still prevails. The overall yield curve has shifted from steep to a mid-range rise, indicating that the market is moving from "perfect pricing" to a "realistic correction."

Technical indicators show bullish momentum

From a technical perspective, the 240-minute chart of the 10-year yield indicates a bullish short-term momentum. The current level of 4.103% is close to the upper Bollinger Band (20,2) at 4.105%, with the middle band at 4.016% providing dynamic support. In the MACD indicator, both the DIFF and DEA lines are positive, with the DIFF crossing above the DEA, and the histogram turning positive, suggesting strengthening upward momentum, but not yet entering overbought territory. Trend resistance is located around 4.09%, with the 50-day moving average at 4.109% forming the upper limit of the range. Before the release of key data, the yield may fluctuate within this range.

Technical analysts point out that the previous drop in yields below 4% had triggered expectations of "perfect pricing," but the Fed's statements disrupted this equilibrium, pushing yields back from the lower bound. Despite the bullish technical outlook, if the MACD histogram narrows, yields may return to the 4.03%-4.08% trading range.

Short-term outlook: Range-bound trading awaiting data guidance.

Over the next 2-3 days, the 10-year yield is expected to fluctuate between 4.03% and 4.08%, with the upper and lower limits forming resistance and support levels respectively. With no data releases on Thursday, the market will focus on speeches by Federal Reserve officials and the results of the Treasury bill auction. The issuance of $205 billion in 4-week and 8-week Treasury bills will test front-end demand; strong subscriptions could help stabilize short-term yields.

The delayed release of unemployment claims and GDP data remains a key variable. If continuing unemployment claims rise as expected, it could further solidify market caution and push the yield curve slightly upward. If the double-bottom pattern holds, the 5s/30s yield spread may fall to around 89.5bp, and the 30-year yield above 4.65% will dominate the long-term trend.

Overall, this round of adjustments marks a shift in the market from a frenzy of interest rate cut expectations to a more rational phase reliant on data. Before the release of key economic data, yields are likely to remain range-bound, awaiting new breakout signals.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.