Amid the US dollar's strong rebound, risk assets and gold face a life-or-death crisis! How should investors position themselves?

2025-10-30 20:53:32

After the volatility triggered by the Federal Reserve's interest rate decision on Wednesday, the market stabilized. The Fed lowered the federal funds rate from 4.25% to 4.00% as expected, marking its second rate cut this year, fully in line with market expectations.

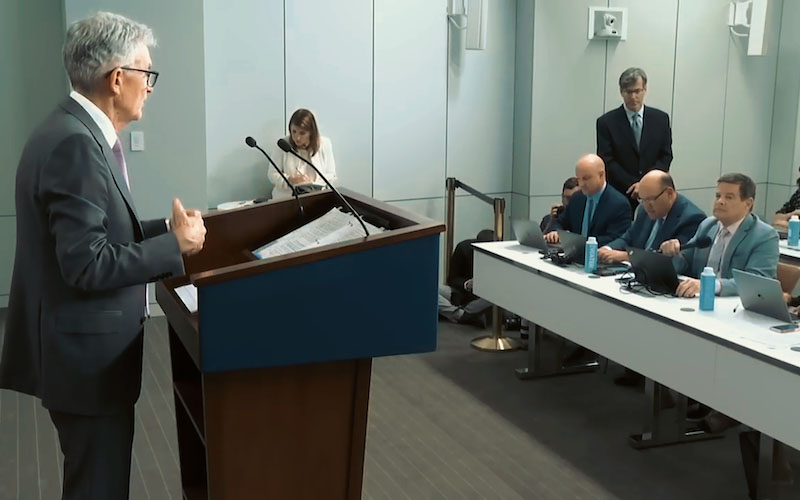

Federal Reserve Chairman Jerome Powell's remarks following the interest rate decision were cautious, making it clear that the future policy path will depend heavily on economic data. This guidance directly led to a significant cooling of market expectations for another rate cut in December.

Short-term US Dollar Trends and Market Focus

The US president stated that the two sides have reached a preliminary agreement: to reduce tariffs on some goods in exchange for free trade in rare earths and minerals, and in return for China resuming its purchases of US soybeans.

A recap of Thursday's key market events: The Federal Reserve, as expected, cut interest rates by 25 basis points to a range of 3.75%-4.0%, while also announcing the end of its quantitative easing program. Before Fed Chairman Powell's speech, the dollar remained largely unchanged; in his speech, Powell clearly stated that due to structural conflicts between the labor market and the inflation outlook, there were significant differences of opinion regarding the direction of monetary policy, making a December rate cut far from a certainty.

Meanwhile, the latest U.S. pending home sales data showed a 0.0% increase month-over-month, far below the market expectation of 1.6%, confirming the continued weakness in the U.S. housing market. Due to the ongoing U.S. government shutdown, the quarterly GDP, PCE, and consumer spending data scheduled for release today will not be available.

US Dollar Index Trends and Market Impact

The downward trend of the US dollar index was effectively contained in July, and it has since embarked on a steady upward trajectory. Since mid-July, the US dollar has continued its recovery, a trend that has had a substantial impact on the pricing of global risk assets.

There are multiple interpretations of why the downward trend of the US dollar has been broken, but for investors, the impact path is clear: the rebound of the US dollar will directly suppress market risk appetite, weaken the driving logic of earnings growth of the S&P 500 (SPX) index, and pose a significant negative factor to the bullish outlook of gold and the entire precious metals sector.

Despite ongoing discussions about dollar depreciation and de-dollarization, the dollar has shown unexpected resilience since the US Dollar Index (DXY) hit a bottom near 96 this summer. To date, the dollar index has rebounded by approximately 3%, and recent trends suggest that the probability of breaking through the key psychological level of 100 is steadily increasing.

Steve Engle, Global Head of FX Strategy at Standard Chartered Bank, has maintained a bullish view on the US dollar recently, believing that "the market has significantly underestimated the potential risks of a dollar rebound."

In his strategy report released last week, he clearly pointed out that the United States is in a period of rapid productivity growth, a trend that will attract more portfolio funds to flow into the US market, push up the equilibrium real interest rate level, and thus provide sustained support for the US dollar.

England is not the only institutional figure skeptical of the de-dollarization trend. He stated that "the evidence for de-dollarization remains highly uncertain," and emphasized that "despite heated discussions in the market surrounding the diversification of foreign exchange reserves, reserve managers remain extremely cautious when selling dollar assets."

Federal Reserve Chairman Jerome Powell's guidance that a December rate cut is not a given has reduced market expectations for a December rate cut from over 90% to 69% (based on the pricing of federal funds rate futures FF00), while simultaneously pushing the 10-year U.S. Treasury yield back above 4%. Historically, higher interest rates have typically supported the dollar exchange rate.

In its latest report released on Wednesday, England reiterated its contrarian view, arguing that the Federal Reserve may not even cut interest rates in 2026.

The correlation between a stronger dollar and risk appetite

Why might a stronger dollar dampen market risk appetite? From an asset perspective, the US dollar has long been considered a core safe-haven currency, and its strengthening cycles often coincide with periods of escalating market risk events and increased uncertainty, and vice versa. When investor confidence is high, they tend to allocate more to higher-risk assets such as stocks, emerging market assets, and commodities.

At the same time, as the "pricing currency" of global trade and financial markets, a stronger US dollar usually indirectly suppresses global economic growth by increasing financing costs and suppressing exports.

For U.S. stock market investors, the weakening dollar had previously been a significant factor driving earnings growth in the S&P 500 index—a large proportion of the revenue of the index's constituent companies comes from overseas markets.

When market sentiment was most bearish on the dollar this summer, UBS released a report stating that for every 10% drop in the dollar, S&P 500 earnings would increase by an additional 2.5%. Wisdom Tree Investments further added data: "In any six-month period, if the dollar weakens, the historical average increase in S&P 500 earnings is 6%."

The market is currently questioning the high valuations of large-cap tech stocks and AI-themed stocks. Against this backdrop, any factors that could weaken earnings growth (including a stronger dollar) will put substantial downward pressure on the S&P 500.

The correlation between the US dollar's performance and commodities

The weakening dollar since 2025 has generally provided support for commodity prices, with gold benefiting the most. A substantial rebound in the dollar would at least weaken one of the core drivers of gold's rise – especially given that many traders are currently discussing whether the rebound will halt when gold prices reach the $4,000 mark due to a stronger dollar.

Furthermore, the anticipated decline in tariffs may reduce inflation expectations that drive up gold prices (one of the main drivers of gold price increases); at the same time, the easing of trade tensions between the world's two largest economies will also reduce periods of geopolitical uncertainty and decrease market demand for gold as a traditional store of value.

From a traditional trading perspective, gold and the US dollar exhibit a negative correlation; therefore, a rebound in the dollar poses a clear obstacle to further gold price increases. From a pricing mechanism standpoint, commodities are priced in US dollars, and a stronger dollar directly increases the import costs of commodities in other currencies, thereby suppressing end-user demand and ultimately putting downward pressure on commodity prices.

Technical Analysis:

The US dollar index has broken through the rising wedge pattern and the key level of 99.36. If it can hold above 99.36, the dollar is expected to continue to strengthen. Currently, 99.36 will be the nearest support level.

(US Dollar Index Daily Chart, Source: FX678)

At 20:50 Beijing time, the US dollar index

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.