Fed December rate decision: Hawkish rate cut hints at a turning point, rate cut cycle enters countdown.

2025-12-11 03:45:48

The Federal Reserve cut interest rates again, but hinted that the current rate-cutting cycle may be coming to an end. From the most dissenting votes in six years and the most dispersed dot plot since 2014, to the tightened wording of the meeting statement and more optimistic economic forecasts, multiple signals combined make the Fed's policy shift clear: unless employment data deteriorates significantly in the coming months, there may only be one rate cut in 2026, or even a complete halt to rate cuts.

Key outcomes of the resolution: The 25 basis point rate cut has been realized; the 40 billion yuan bond purchase was a technical operation.

The most anticipated interest rate adjustment of this meeting was implemented as expected: the Federal Reserve announced a 25 basis point cut to the federal funds rate, lowering the target range from 3.75%-4.00% to 3.50%-3.75%. This is the third rate cut since 2025, with a cumulative reduction of 75 basis points, continuing the easing pace throughout the year. Simultaneously, the Fed also lowered several key interest rate tools: the interest rate on excess reserves (IORB), the reverse repurchase rate (ON RRP), and the discount rate were all reduced by 25 basis points along with the benchmark rate. At the same time, the Fed removed the cap on standing repurchase operations to enhance its short-term liquidity adjustment capabilities.

It is worth noting that the meeting also announced an important liquidity management measure: resuming reserve-managed bond purchases starting December 12th, with a plan to buy approximately $40 billion in short-term Treasury bonds within 30 days. The initial purchase volume will be maintained at a relatively high level in the coming months, followed by a "significant reduction" in the pace of purchases. The Federal Reserve explicitly emphasized that this bond purchase is not a restart of quantitative easing (QE), but rather a purely technical operation. Its core purpose is to alleviate potential liquidity pressures in the overnight lending market and ensure the smooth operation of the money market. On the surface, the interest rate cut and liquidity support measures seem to have met some market expectations. However, considering other details of the meeting, it is not difficult to see that these easing actions are more of a continuation of policy inertia than the start of a new round of easing. The easing cycle has reached a clear turning point.

The voting results highlight internal divisions: for the first time in six years, three dissenting votes were cast.

The voting results of this interest rate decision serve as direct evidence of the escalating policy disagreements within the Federal Reserve. The final decision was passed with 9 votes in favor and 3 against. This number of dissenting votes not only set a record high since 2019 but also marked the first time since 2014 that three dissenting votes had been cast, highlighting the deep divisions among Fed officials regarding the balance between inflation and employment, and the pace of policy implementation.

Specifically, the opposition is characterized by a "two-way split": Austan Goolsbee, president of the Federal Reserve Bank of Chicago, and Jeffrey Schmid, president of the Federal Reserve Bank of Kansas City, who have voting rights in 2025, explicitly oppose the rate cut, arguing that the fundamentals of the US economy remain resilient and inflationary pressures have not completely subsided, making a rate cut unnecessary at this time; conversely, Federal Reserve Governor Stephen Miran holds a radical dovish stance, advocating for a one-time rate cut of 50 basis points to address the downside risks to the economy with a more forceful policy approach.

Dow Jones reported, "This is the first time in six years that three officials have voted against a rate cut. Behind this rare voting pattern lies a fierce internal struggle within the Federal Reserve over the relative importance of inflation and the job market. Faced with the dilemma of balancing multiple objectives, this rate cut decision may ultimately depend on the personal preference of Fed Chairman Powell, highlighting the complexity and uncertainty of current policy-making." In fact, this internal division had already begun to emerge in previous meetings, and the surge in dissenting votes this time indicates that the disagreement has reached a peak.

The dot plot is completely torn apart: the median remains unchanged, and the divergence is the largest in 11 years.

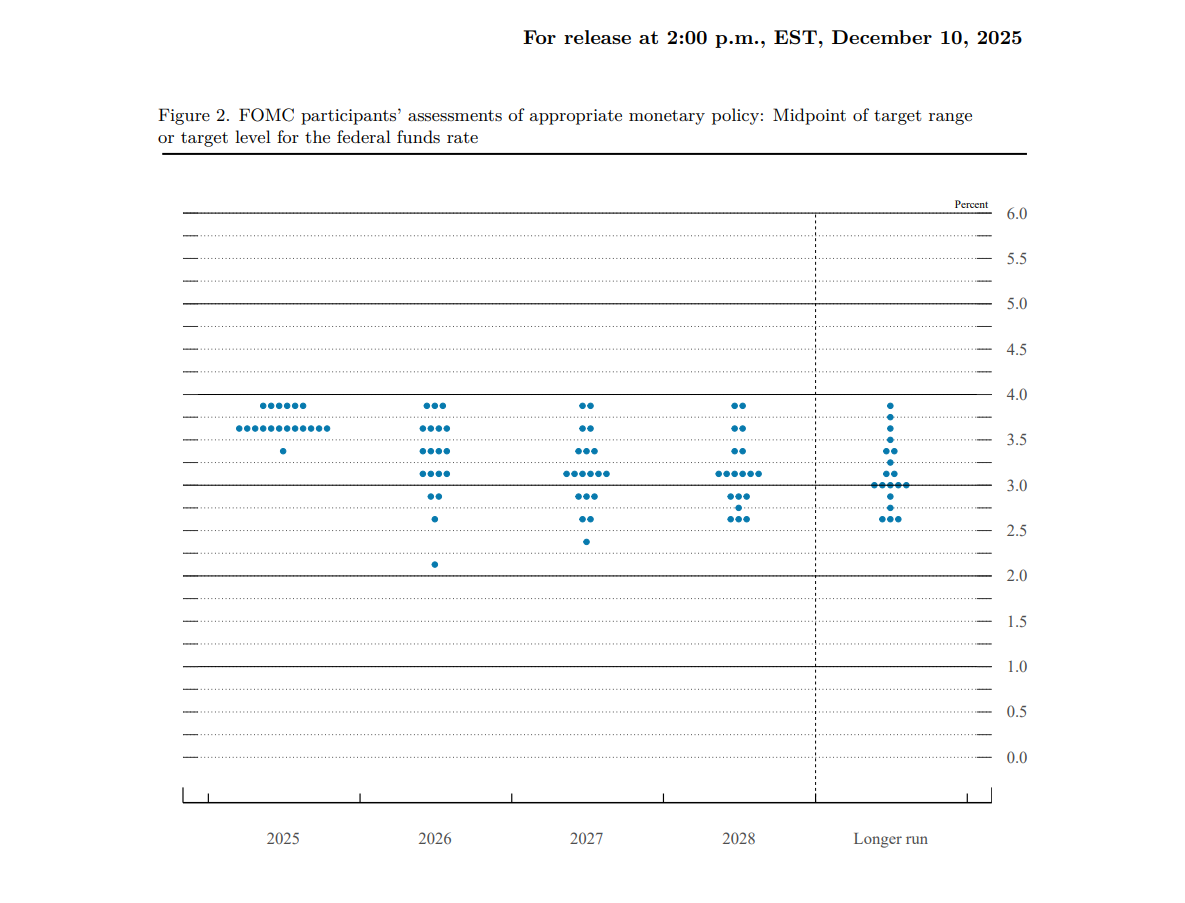

As a crucial guide to the Federal Reserve's policy path, the dot plot released this time exhibits a distinct characteristic of "stable median but fragmented distribution." The overall median path is entirely consistent with the projections from the September meeting: a median federal funds rate of 3.6% at the end of 2025, 3.4% at the end of 2026, and 3.1% at the end of 2027, with the long-term neutral interest rate expected to remain at 3.0%. However, the specific distribution of the dots among the 19 Federal Reserve officials reveals the highest dispersion since 2014, directly reflecting significant internal disagreements on the future policy path.

The divergence in interest rate path predictions for 2026 is particularly pronounced: among the 19 officials, 7 believe that the current interest rate level should be maintained throughout 2026 without a rate cut, while 3 even advocate for a rate hike. This means that the hawkish camp, advocating for both no rate cuts and rate hikes, comprises 10 officials, exceeding 50% for the first time, reaching 52.6%. On the dovish side, an unprecedentedly extreme view emerged – one official believes that there should be a total of 6 rate cuts in 2026, with a total reduction of 150 basis points, a stark contrast to the hawkish camp. Furthermore, in the year-end interest rate predictions for 2025, 6 officials chose a range of 3.75%-4.00%, significantly higher than the target range of 3.50%-3.75% set at this meeting, essentially implying that "a rate cut in December should not have been implemented."

Federal Reserve officials are using the dot plot to signal their dissenting opinions, with differing viewpoints clashing fiercely and internal divisions reaching unprecedented levels. This disagreement stems not only from differing assessments of economic fundamentals but also from divergent perceptions of inflation resilience and the job market outlook.

Economic forecasts and statement wording: Hawkish tone fully escalates

The Summary of Economic Projections (SEP) and the meeting statement released concurrently with this meeting further reinforced the hawkish policy orientation. Regarding economic projections, the Federal Reserve's assessment of the U.S. economic outlook has become significantly more optimistic: GDP growth forecasts for 2025 and 2026 have both been revised upwards, with the 2026 GDP growth forecast being significantly revised upwards from 1.8% in September to 2.3%; while inflation path forecasts have been revised downwards, the core PCE inflation rate remains above the long-term target of 2%, with a core PCE inflation rate forecast of 3.0% for 2025; the unemployment rate forecast maintains a moderate upward trend, expected to rise only to 4.5%, indicating that the Federal Reserve believes the labor market remains resilient.

The wording changes in the meeting statement more directly conveyed a tightening policy stance: the statement removed the previously mentioned phrase "low unemployment rate," and added statements such as "inflation has risen since earlier this year and remains relatively high" and "job growth has slowed, and the unemployment rate has risen slightly," while repeatedly emphasizing that "uncertainty about the economic outlook remains high" and "policy needs to address two-way risks." These changes in wording indicate that the Federal Reserve has begun to place greater emphasis on inflation risks while remaining vigilant about the slowdown in the job market, and the policy balance is tilting towards "inflation prevention."

The current US economy presents a complex situation with both strong price pressures and a cooling labor market, presenting the Federal Reserve with a challenging trade-off it hasn't faced in decades. Historically, during the stagflation of the 1970s, the Fed adopted a stop-and-go policy approach, ultimately leading to deeply entrenched high inflation. The Fed is clearly striving to avoid repeating this mistake, which is a key reason for its hawkish signals.

Market's immediate reaction: Hawkish signals trigger sharp fluctuations

Following the Federal Reserve's decision, global financial markets reacted swiftly to this "hawkish rate cut" signal, with asset prices showing a brief surge followed by a rapid decline. In the precious metals market, spot gold prices jumped $16 immediately after the announcement, briefly reaching a high of $4,217 per ounce, but subsequently fell back quickly, reflecting the market's adjustment to the disappointment of unmet expectations for further easing. The US stock market also exhibited a similar pattern, with investors quickly digesting the hawkish signal after the initial excitement of the rate cut, and risk appetite cooling significantly.

The interest rate market reacted more directly: interest rate futures data showed that the market's expectation of the probability of the Federal Reserve pausing rate cuts in January 2026 rose rapidly from 70% before the decision to 78%, indicating that the market has quickly adjusted its expectations for subsequent policies; the yield on 10-year US Treasury bonds, which is the benchmark for long-term interest rates, rebounded to around 4.18% after the decision was announced, reflecting the market's recognition of the Fed's policy shift.

Wall Street institutions generally agree that this rate cut is a typical "hawkish rate cut," with the apparent easing measures masking a clear intention to tighten policy. The Fed's announced $40 billion bond-buying program is merely a technical measure to alleviate liquidity pressures and does not signal the start of a new round of quantitative easing. Investors should not misinterpret this policy signal.

Future Outlook: Powell's final test in office, the rate-cutting cycle enters its countdown.

The Federal Reserve's current policy direction is also facing a unique political context: Chairman Powell's term will expire in May 2026, meaning he only has three more opportunities to chair interest rate meetings, while US President Trump has clearly indicated that he will soon nominate a successor. Against this backdrop, the policy statements made at this meeting are not only related to current economic regulation but may also lay the groundwork for his successor's policy stance, thus carrying special transitional significance.

From a policy perspective, the current federal funds rate is already close to the neutral level deemed by the Federal Reserve, significantly reducing both the room for and the impetus for further rate cuts. As UBS Chief Economist Jonathan Pingle stated, "Every rate cut loses more support from participants; you need data to bring them back to the majority." This means that without sufficiently strong economic data to support it, the Federal Reserve will find it difficult to push for further rate cuts in the future.

Based on analyses from various sources, unless a series of very disturbing events occur in the US job market in the coming months—including a continued rise in initial jobless claims, an expansion of corporate layoffs, and a steady increase in the unemployment rate—the number of interest rate cuts in 2026 is likely to be less than the one predicted in the dot plot, and may even be suspended altogether. This indicates that the bells of this interest rate cutting cycle have not completely stopped ringing, but the countdown has clearly begun.

Powell is holding a press conference at 3:30 AM Beijing time on December 11th. The market widely expects this to be his most difficult communication during his tenure – he must explain the policy logic behind this "hawkish rate cut," balance serious internal disagreements, and provide clear guidance for future policy paths. This may also be his last chance to lay the policy floor for his successor.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.