Have tariffs been withdrawn? The resilience of the global economy and future risks.

2026-02-10 20:27:41

At the beginning of the new year, reviewing past economic trends will help us see the future direction more clearly.

Global trade barriers have risen significantly compared to a year ago, and tariffs have become the norm in economic operations, rather than a fleeting policy experiment.

Previously, the prevailing view in the market was that tariffs would be very detrimental to the global economy, suppressing economic growth and disrupting inflation trends. However, in reality, the global economy has not suffered as severe as expected, and the evolution path has deviated significantly from market predictions.

Inflation divergence: the core difference between supply shocks and demand shocks

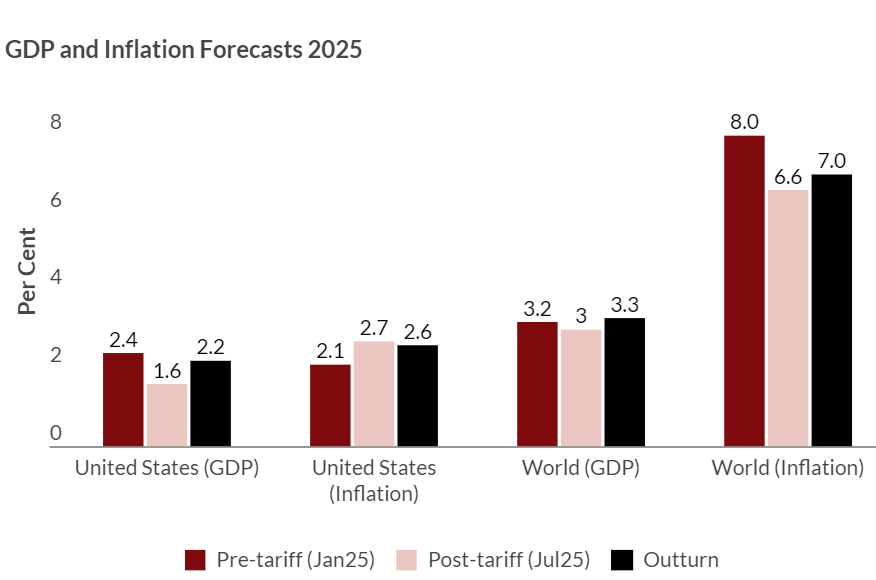

In early 2025, institutions predicted that the US economy would grow by 2.4% and the global economy by 3.2%. After the tariff policy was implemented, the growth forecasts were lowered to 1.6% and 3%, respectively, and pessimism about the economic outlook spread in the market.

Regarding inflation, forecasts after the tariffs take effect show that the US inflation rate will rise to 2.7%, while the global inflation rate will fall to 6.6%, showing completely opposite trends.

The core logic behind the divergence between US and global inflation trends lies in the fundamentally different impacts of tariffs on the two economies: for the US, tariffs are a typical supply shock, while for the global economy, tariffs are a demand contraction shock.

(Comparison chart of expected GDP and inflation before and after tariffs with actual data)

Tariffs are essentially taxes levied on imported goods. Businesses will pass on some of the costs to end consumers. Therefore, the US tariffs directly push up domestic prices and at the same time inhibit the expansion of domestic economic activity.

However, looking at the global market, the sharp contraction in US import demand has left exporting countries facing a global demand gap, and the oversupply of goods has directly lowered the global inflation rate.

Three supporting factors: the global economy's resilience to tariff shocks

Despite global tariffs, the global economy has shown remarkable resilience, with some sectors exceeding expectations. A comparison of post-tariff forecasts and actual economic data reveals that while the market's initial assessment was correct, its predictions regarding the magnitude of the impact were overly aggressive.

Inflation trends closely followed forecasts, but the decline in GDP fell far short of expectations. The global economy demonstrated an unexpected resilience and adaptability, a phenomenon known as the "global resilience puzzle."

There are three main driving factors behind the resilience of the global economy:

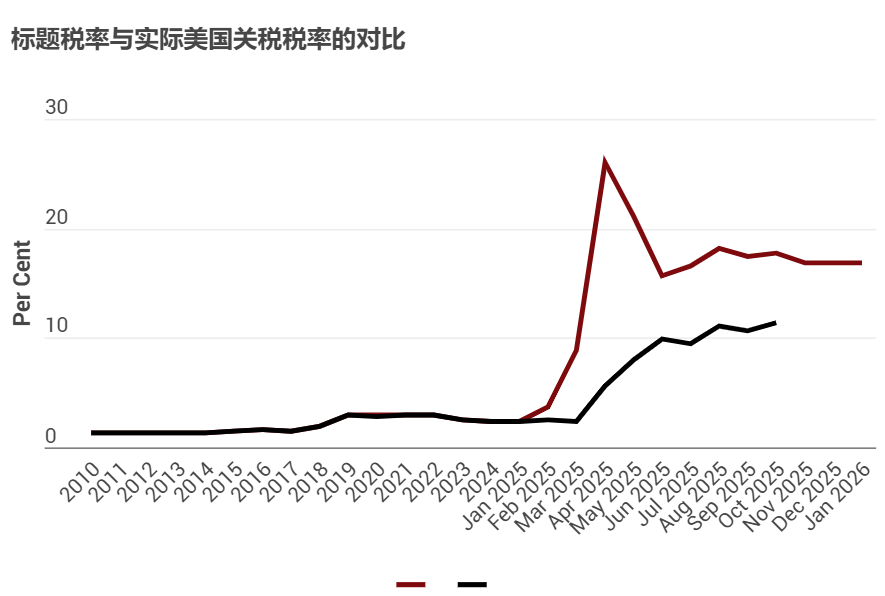

First, the actual effectiveness of tariffs is far lower than the nominal tariff rate.

While the nominal tariff rate has attracted significant market attention, the effective tariff rate actually collected by U.S. Customs is only about half of the officially announced rate.

Data from January 2026 shows that the average nominal tariff rate in the United States is 18%, while the effective tariff rate is only 9.2%.

This means that the market needs to face the impact of tariffs squarely, but should not be overly disturbed by the superficial figures of nominal tax rates.

(Trend chart of nominal tax revenue and actual tax revenue)

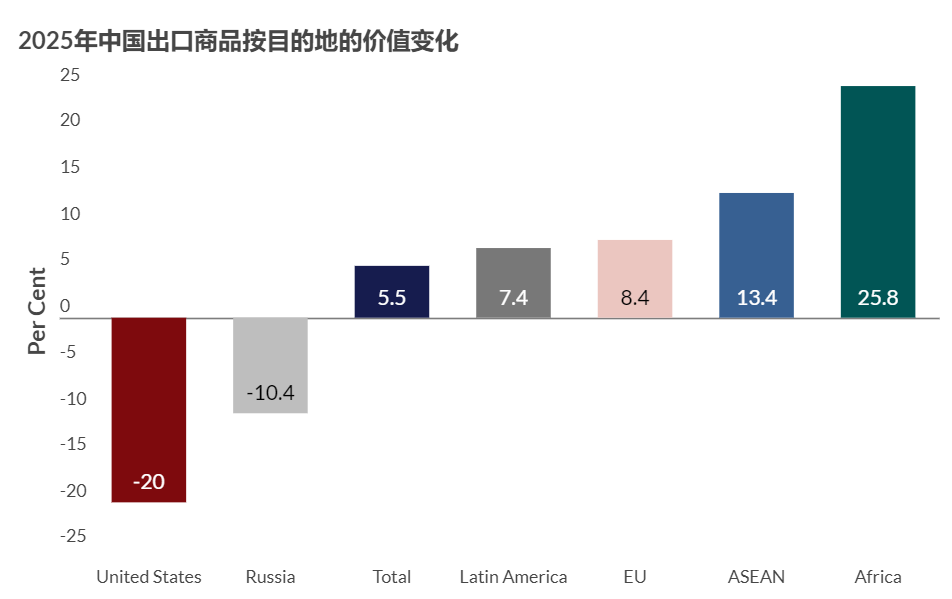

Second, the trade diversion effect supports the resilience of exports. Unlike the economic crises of 2008 and 2020, the global export scale will not decline significantly in 2025, with trade diversion becoming a key buffer.

Taking China's exports as an example, exports to the US fell by 20%, but exports to Africa, Latin America and Southeast Asia increased, which completely made up for the shortfall. Tariffs did not destroy export momentum, but only restructured global trade flows. However, the long-term sustainability of the new trade pattern remains to be seen.

(A list of China's export regions and their respective percentages)

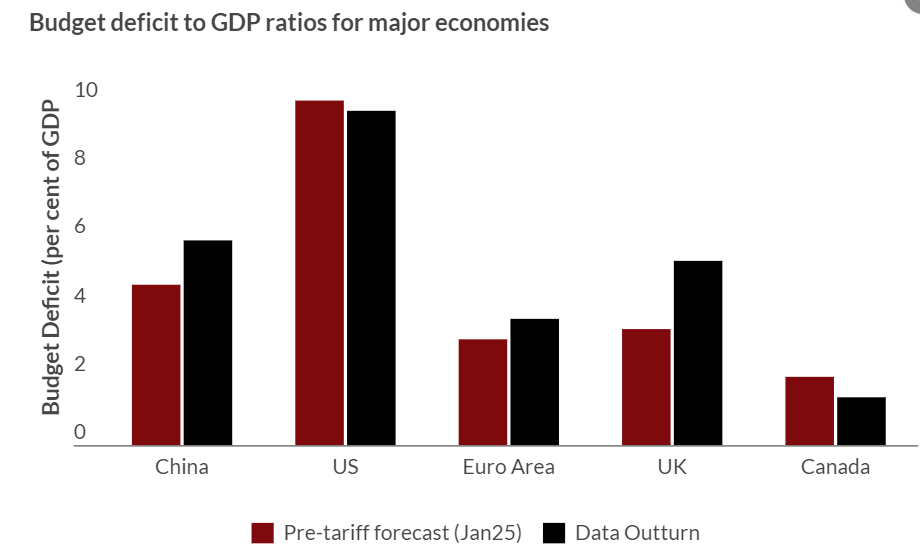

Third, loose fiscal policies have buffered the impact of tariffs. Global fiscal policies have continued to be loose and supportive after the pandemic. In 2025, the fiscal deficits of the United States and China as a percentage of GDP will reach historical highs of about 10% and 6% respectively, while the deficits of the Eurozone and the United Kingdom will also exceed expectations.

Large-scale government spending effectively offset the negative impact of tariffs, but loose fiscal policy also pushed up borrowing costs, creating potential risks to medium-term fiscal sustainability.

(Comparison chart of debt-to-GDP ratios of various countries)

In conclusion: Behind the resilience of tariffs, hidden vulnerabilities in the global economy.

Despite the apparent robust and resilient growth of the global economy, its inherent vulnerabilities have long been lurking.

The impact of tariffs has been partially absorbed by fiscal easing, trade diversion, and dollar depreciation, but the sustainability of these hedging factors remains questionable.

The implicit costs of tariffs are not reflected in GDP data; instead, they translate into higher market risk premiums and a weaker dollar.

This also means that the policy buffer space for the global economy is extremely limited. For example, the scale of national debt in various countries. If they fail to grasp important economic growth points in the future, or encounter new external shocks such as the correction in the AI sector, the shocks are likely to be quickly transmitted to the fields of employment and investment. Ultimately, coupled with the deterioration of government debt repayment, there may be a chain reaction of currency devaluation and asset price decline.

Although the global economic buffering process has left many hidden concerns, the impact of the tariff war on the market has become limited. In fact, after the United States announced a 25% tariff on South Korean automobiles at the end of January, the South Korean stock market rose instead of falling.

Therefore, the impact of tariffs on the gold and equity markets is more of a one-off event that will be quickly corrected. The counterintuitive aspect is that the multifaceted effects of tariffs will become a focus that the market needs to track and pay attention to in the long term.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.