Institutions: Due to ongoing structural uncertainty, Warsh's nomination will not hinder gold price gains.

2026-02-20 11:14:01

Kevin Flanagan, head of investment strategy at WisdomTree, said that the sharp drop in gold prices last month after President Trump nominated Warsh to be the next Federal Reserve chairman was more due to position adjustments than to fundamental factors.

After a parabolic rally in late January that pushed gold prices to a record high of nearly $5,600, gold is susceptible to profit-taking. Flanagan believes that Walsh's headline is merely an excuse for the current pullback, not the real reason. He said, "The market has experienced this parabolic rally, some profit-taking, consolidation, and pullbacks, and whatever you call it, it's beneficial for the market."

The market initially interpreted Warsh's nomination as a stabilizing factor for monetary policy. Flanagan pointed out that Warsh is seen as an experienced policymaker who understands the value of central bank independence. He stated, "He has accomplished many important tasks and fully understands the concept of Federal Reserve independence."

Warsh's experience during the period of conventional monetary policy and the 2008 financial crisis makes him familiar to investors, especially given the high level of political scrutiny he faces. However, while this nomination may alleviate concerns about direct political interference in the Federal Reserve, Flanagan cautions that it does not eliminate broader uncertainty or diminish gold's strategic role.

In fact, he pointed out that the real test might come at Warsh's first meeting. He said, "If the employment data continues to be strong and inflation remains above target, then Warsh is very likely not to cut rates."

If this happens, tensions between the White House and the central bank could quickly resurface. Warsh may bring institutional credibility, but he cannot eliminate political divisions. Flanagan added that this ongoing tension is likely to support gold prices.

He also dismissed concerns about a threat to the Federal Reserve's independence. He pointed out that given the institution's structure, worries about the Fed being politically manipulated are exaggerated. The composition of the Federal Open Market Committee (FOMC), including 12 voting members (who also serve as rotating regional bank presidents), acts as a shield against unilateral influence. He said, "The Fed's structure guarantees its independence."

Even with the appointment of additional board members, Senate approval, and a balance of power between regional governors and board members, large-scale policy changes should be prevented. This framework should provide reassurance to U.S. investors. However, Flanagan also acknowledges that non-U.S. investors may be more sensitive to perceived institutional instability and broader concerns about the dollar.

Importantly, even if a resilient economy and persistently high inflation prevent the Federal Reserve from cutting interest rates this year, he believes this will not have a significant impact on the gold market. He emphasizes that central banks are not far from ending their easing cycle, but rather just beginning. He says, "We are in or near the end of this rate-cutting cycle." If the Fed cuts rates one or two more times, it will only be a moderate adjustment, not a return to extremely loose monetary policy. A significant drop in interest rates could be preceded by an economic recession, which is not WisdomTree's fundamental assessment.

This shift is significant. If the market has largely shrunk its expectations of interest rate cuts, gold can no longer be defined solely by interest rate expectations. Flanagan argues that, instead, gold is responding to a broader and more enduring range of factors.

He stated that, aside from monetary policy, the key factors supporting gold prices remain unchanged, including geopolitical tensions, ongoing trade wars and tariff uncertainty, and continued gold purchases by central banks. He emphasized that these structural factors have not disappeared with Warsh's nomination. He said, "Geopolitics, trade wars, tariffs, central bank buying—it's all still there; it hasn't gone away."

Perhaps the most important point in Flanagan's argument is that gold no longer reacts to individual news items, but rather to a long-standing environment of multiple uncertainties. Tariff rulings, trade negotiations, fiscal expansion, rising global debt levels, and political friction between the executive branch and central banks are not isolated events, but rather structural features of the current system.

"These uncertainties will persist over the next three years," Flanagan said. He also noted that gold is increasingly playing the role of a neutral asset for investors to hold amid ongoing policy volatility.

From this perspective, Warsh's nomination did not end the uncertainty; it merely changed its form. The market may have a clear understanding of the Fed's leadership, but it is unlikely to have a clear understanding of trade policy, fiscal expansion, or political tensions. That lingering ambiguity—the uncertainty within uncertainty—continues to underpin gold's strategic appeal.

He said, "Gold is no longer seen as a tactical asset allocation, but rather as a strategic asset portfolio allocation."

For him, the recent pullback is not the end of the gold bull market, but a normal consolidation in an environment where systemic risk, rather than interest rate cuts, is becoming the dominant factor.

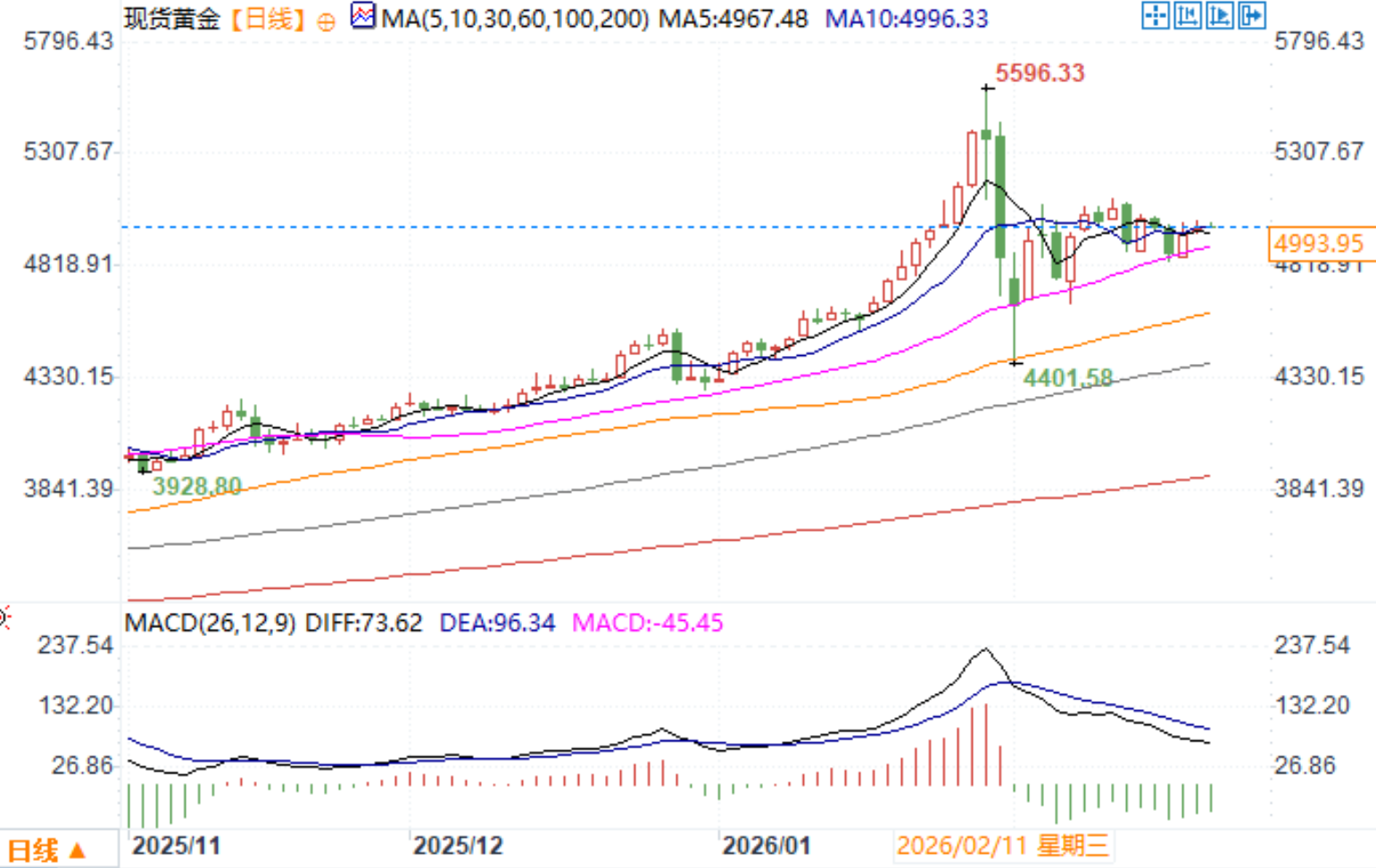

Spot gold daily chart source: EasyForex

At 11:12 AM Beijing time on February 20, spot gold was trading at $4993.95 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.