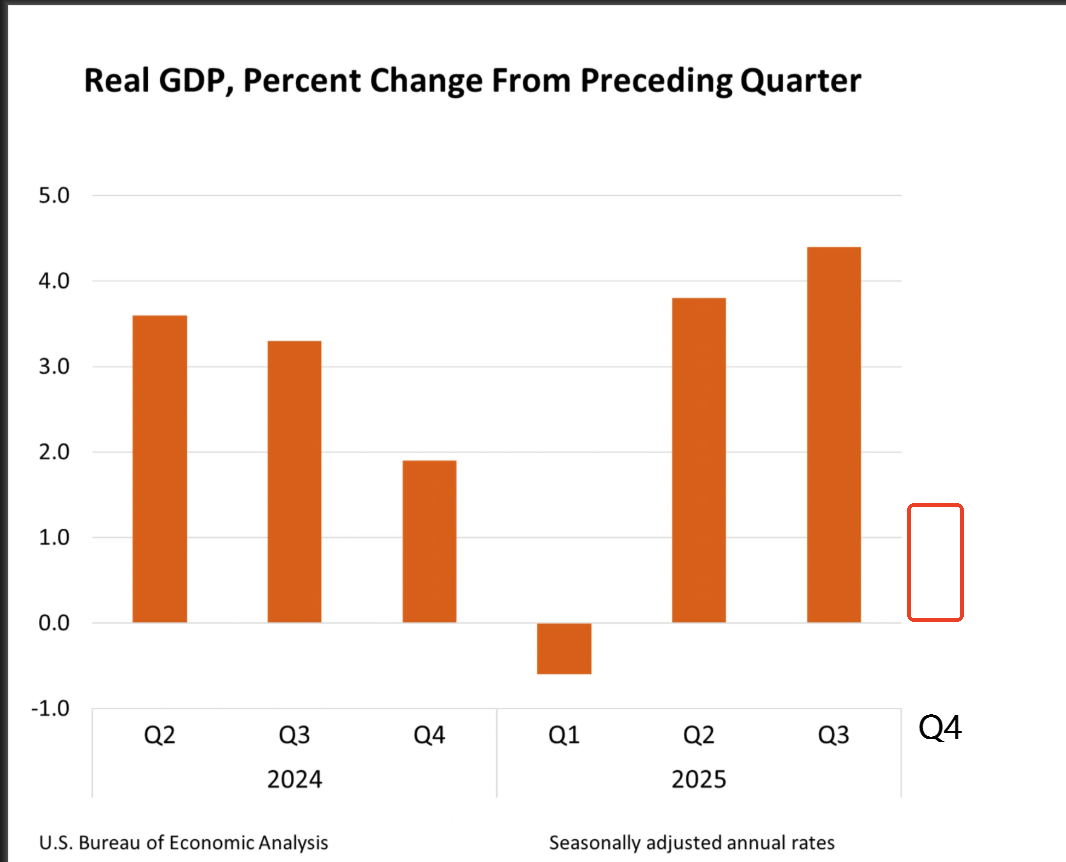

A disappointing GDP figure and a stubbornly stagnant PCE! Dollar bulls celebrate, but dreams of interest rate cuts are dashed?

2026-02-20 21:51:44

The slowdown in growth was mainly due to the lingering impact of the prolonged government shutdown from October to mid-November last year. Weak consumption and structural imbalances in the labor market further exacerbated market concerns about economic momentum.

Market performance:

With GDP falling short of expectations, but impacted by the one-off shock of the US government shutdown and sticky inflation, expectations for a Fed rate cut cooled, the dollar index saw an upward pulse, and gold fell.

GDP growth slowed but resilience remained, highlighting structural concerns.

The 1.4% growth rate was significantly lower than market expectations and broke the overheated growth of the previous quarter, which has had a certain impact on the "American economic exceptionalism".

The government shutdown was considered a key drag, with Wells Fargo estimating that the factor lowered growth by about 1.2 percentage points, but the economic fundamentals remained solid after removing the disruption.

The labor market appears strong, but new jobs are highly concentrated in the healthcare sector, leading to a significant downward revision of overall employment data and highlighting the risk of structural imbalances.

Consumer spending, which accounts for nearly 70% of GDP, is showing signs of weakness, with stagnant retail sales and pressure on consumer confidence becoming major drags on economic growth.

PCE inflation exceeded expectations, but GDP growth slowed, raising the risk of stagflation.

The December Personal Consumption Expenditures (PCE) price index, released concurrently with GDP, showed that both overall PCE and core PCE rose to 3.0% year-on-year, significantly exceeding market expectations.

As the Federal Reserve's most valued inflation indicator, this data confirms that inflation remains sticky and is still significantly below the 2% policy target.

The combination of low growth and high inflation has put the Federal Reserve in a policy dilemma: the economic slowdown does not support aggressive interest rate hikes, but persistent inflation makes it difficult to initiate interest rate cuts, and market expectations for the pace of interest rate cuts in 2026 are facing repricing.

The combination of data directly affects the trend of the US dollar index.

This week, the US dollar index has rebounded strongly, driven by robust economic data, a hawkish tone from the Federal Reserve, and geopolitical risk aversion, and is poised to achieve its best weekly performance since October.

The combination of GDP and PCE this time has become the key to testing the strength of the dollar's recovery:

GDP growth was lower than expected, but the impact of one-off shocks such as shutdowns still needs to be observed. Meanwhile, core PCE exceeded expectations, strengthening inflation stickiness and directly suppressing expectations of interest rate cuts.

The decline in initial jobless claims and the improvement in the Philadelphia Fed index further supported the US dollar.

Previously, the lower-than-expected January CPI briefly prompted interest rate cuts, but the better-than-expected PCE this time will significantly reverse market sentiment.

According to the CME FedWatch tool, the probability of the Federal Reserve cutting interest rates by 25 basis points by March is 5.9%, while the probability of keeping interest rates unchanged is 94.1%.

The probability of the Federal Reserve cutting interest rates by a cumulative 25 basis points by April is 20.5%, the probability of keeping interest rates unchanged is 78.5%, and the probability of cutting interest rates by a cumulative 50 basis points is 1.0%.

The probability of a cumulative interest rate cut of 25 basis points by June is 48.1%.

Market linkage and subsequent impact

US Dollar Index: With the economic resilience yet to be observed and inflation stickiness confirmed, the US dollar index is likely to remain strong in the short term, forcing the Federal Reserve to maintain high interest rates for longer and potentially delaying the rate cut cycle until the second half of 2026.

Precious Metals: Goldman Sachs maintains its year-end forecast of $5,400 for gold, but short-term volatility will be significantly amplified due to the strengthening dollar. Overall, the combination of slowing GDP and better-than-expected core PCE creates a macroeconomic environment that is favorable for the dollar and suppresses expectations of interest rate cuts. The short-term rebound trend of the dollar index is expected to continue.

Technically, driven by data, the US dollar index has maintained its bullish support level above 97.86. If it can hold this level, the dollar has room for further rebound. However, it is still in a high-price zone, which may lead to the realization of positive news. There are also concerns in the market about the logic of slowing US economic growth and rising government debt leading to a deterioration in the US government's debt repayment ability, which may cause the dollar to pull back and adjust.

(US Dollar Index Daily Chart, Source: FX678)

At 21:47 Beijing time, the US dollar index was at 97.94.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.