A chart shows the Baltic Dry Index rebounding from a one-week low, supported by stronger Capesize and Panamax freight rates.

2026-02-20 22:54:59

The Baltic Dry Index (BDI) released by the London Baltic Exchange saw a significant rebound on Friday, successfully recovering from the one-week low hit on the previous trading day (February 19th) and achieving a turnaround after a period of consolidation. As a core indicator of the global dry bulk shipping market, the index is primarily used to comprehensively track the overall fluctuations in ocean freight prices for various dry bulk commodities such as iron ore, coal, and grain. Its changes directly reflect the activity of global commodity trade and the health of the international shipping market. This rebound was not accidental, primarily due to the significant strengthening of freight rates for the two main vessel types: Capesize and Panamax. The combined effect of these two sectors effectively offset the slight negative impact of a minor decline in Supramax vessel freight rates, ultimately driving the overall freight rate index steadily higher and injecting a strong boost into the recently volatile dry bulk market.

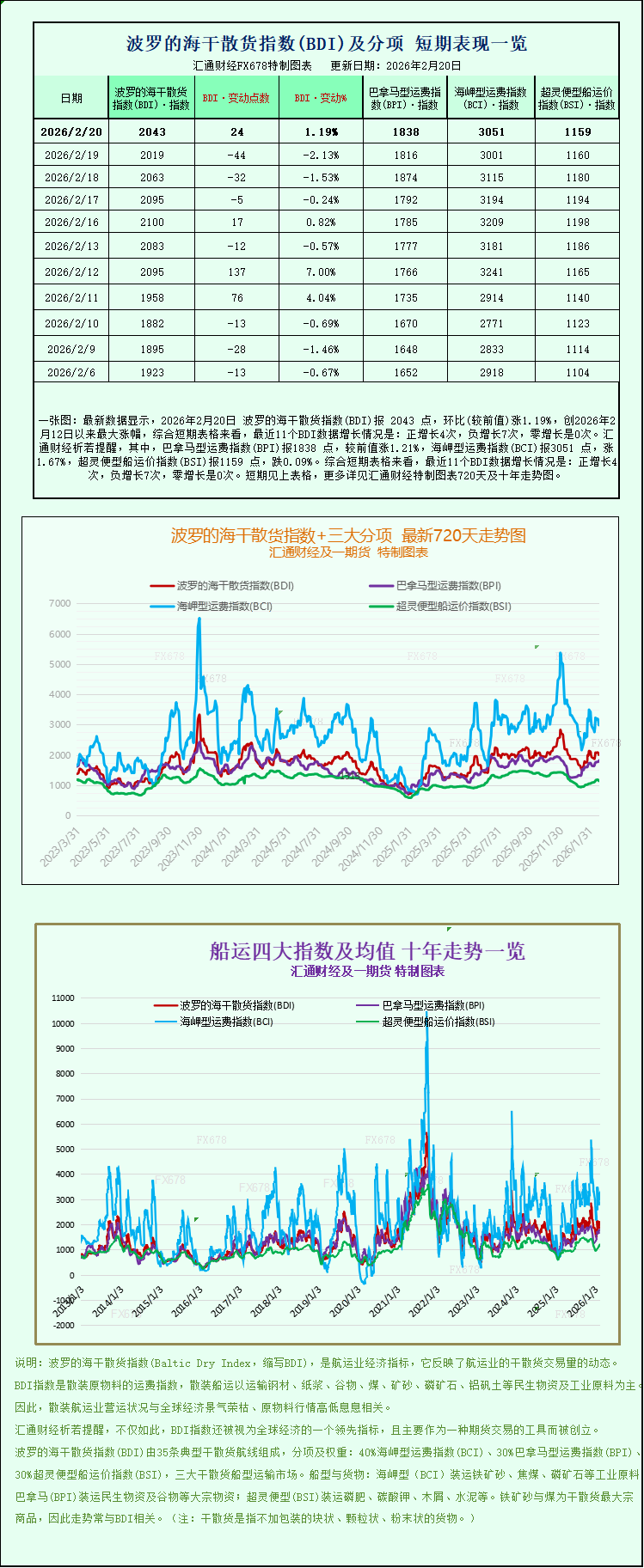

The Baltic Dry Index (BDI), a core comprehensive indicator covering the dry bulk shipping market, comprehensively encompasses freight rates for the three major vessel types: Capesize, Panamax, and Supramax, objectively reflecting the overall supply and demand structure of the global dry bulk shipping market. In trading on February 20th, the index performed strongly, rising 24 points, or 1.2%, to close at 2043 points, ending a three-day downward trend (the index closed at 2019 points on February 19th, a week-long low since February 11th), indicating a significant recovery in market sentiment. This rebound echoes the recent optimistic expectations of some institutions for the dry bulk market. Previously, the globally renowned maritime investment bank Fearnleys raised its 2026 dry bulk freight rate forecast in a research report, believing that market momentum has been continuously strengthening since the fall of 2025, and that global dry bulk shipments have achieved a V-shaped rebound that will continue into 2026.

Among the three main vessel types, Capesize vessels became the core driving force behind the overall index's upward movement, with their freight rates performing particularly well. On that day, the Capesize freight rate index rose 50 points, an increase of 1.7%, ultimately closing at 3051 points, reversing the previous slight decline. Correspondingly, the average daily earnings of Capesize vessels also climbed, increasing by $459 to $24,172, significantly improving the operating efficiency of shipowners. It is understood that Capesize vessels are among the largest vessel types in dry bulk shipping, with a single vessel carrying approximately 150,000 tons of cargo. Their core transport categories are key industrial raw materials such as iron ore and coal. They mainly shuttle between major resource exporting and importing countries globally, undertaking the core task of transporting raw materials for global heavy industry. Therefore, their freight rate performance directly reflects the strength of global demand for industrial raw materials by sea and is also an important indirect reference for the recovery of global manufacturing. The recent strength in Capesize freight rates is mainly attributed to the moderate recovery in global iron ore restocking demand, particularly China's demand for high-quality iron ore. This, coupled with rising expectations for infrastructure projects to commence after the Spring Festival, has further boosted seaborne iron ore demand, providing solid support for Capesize freight rates. This aligns with industry predictions that "Capesize freight rates are expected to remain stable with a slight increase, supported by transportation demand and slower growth in available capacity."

Besides Capesize vessels, the steady rise in Panamax freight rates also provided strong support for the overall market, forming a two-pronged rebound. On that day, the Panamax freight rate index rose 22 points, or 1.2%, to close at 1838 points, continuing its recent upward trend. Simultaneously, the average daily earnings for Panamax vessels also increased by $203 to $16,543, indicating a healthy market for this vessel type. As a mainstay of the dry bulk shipping market, Panamax vessels have a capacity between Capesize and Supramax vessels. Their design conforms to the Panama Canal's navigation standards, and their cargo capacity is typically between 60,000 and 70,000 tons. They mainly transport bulk commodities such as coal and grain, and are an important reference indicator for the global grain and energy shipping market. Their freight rate fluctuations are closely related to the global trade activity of agricultural and energy products. The recent strength in Panamax freight rates is mainly attributed to expectations of a recovery in South American grain exports. Brazil's soybean planting area continues to expand, with production capacity expected to increase by more than 5%. The Argentine government's temporary suspension of export taxes has further boosted South American grain exports, leading to increased demand for grain shipping. Meanwhile, the resilience of global coal shipping demand has also provided supplementary support, jointly driving the steady rise in Panamax freight rates.

In contrast to the strong performance of the two main vessel types, the market for small and medium-sized vessels was relatively flat, with Supramax freight rates experiencing a slight decline, becoming the only weak link in the market that day. The Supramax freight rate index fell slightly by 1 point to close at 1159 points, underperforming the Capesize and Panamax sectors. Supramax vessels, as the core force in small and medium-sized dry bulk shipping, typically have a deadweight tonnage between 40,000 and 60,000 tons. They are highly adaptable to waterways, canals, and ports, and can berth at some smaller ports with less favorable conditions. They mainly carry small batches of dry bulk cargo such as iron ore, grain, fertilizer, and cement, covering a wider area. Their freight rate fluctuations primarily reflect the activity level of small and medium-sized dry bulk trade. The slight decline in Supramax freight rates was mainly due to a slight decrease in short-term activity in small- and medium-volume dry bulk trade, resulting in somewhat weak market demand. This, coupled with the slight increase in available Supramax capacity in 2026, prevented its freight rates from following the rise of the two major vessel types. However, the overall decline was minor and did not significantly impact the overall market rebound. This aligns with the industry's prediction that "the small and medium-sized vessel market will face significant pressure due to declining demand."

In summary, the rebound in the Baltic Dry Index (BDI) on February 20th was a result of both strong demand for major vessel types and improved market sentiment. The increased freight rates for Capesize and Panamax vessels provided strong support, effectively offsetting the slight weakness in smaller vessels. From an industry perspective, global dry bulk shipping demand is expected to see a moderate recovery in 2026. However, the market also faces the risk of fleet capacity growth exceeding demand growth, leading to a temporary oversupply. Therefore, the index is expected to continue its volatile and corrective trend. Nevertheless, with the further recovery in global commodity demand and the arrival of the peak season for South American grain exports, Capesize and Panamax vessels are expected to maintain strong demand, continuing to support the dry bulk market.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.