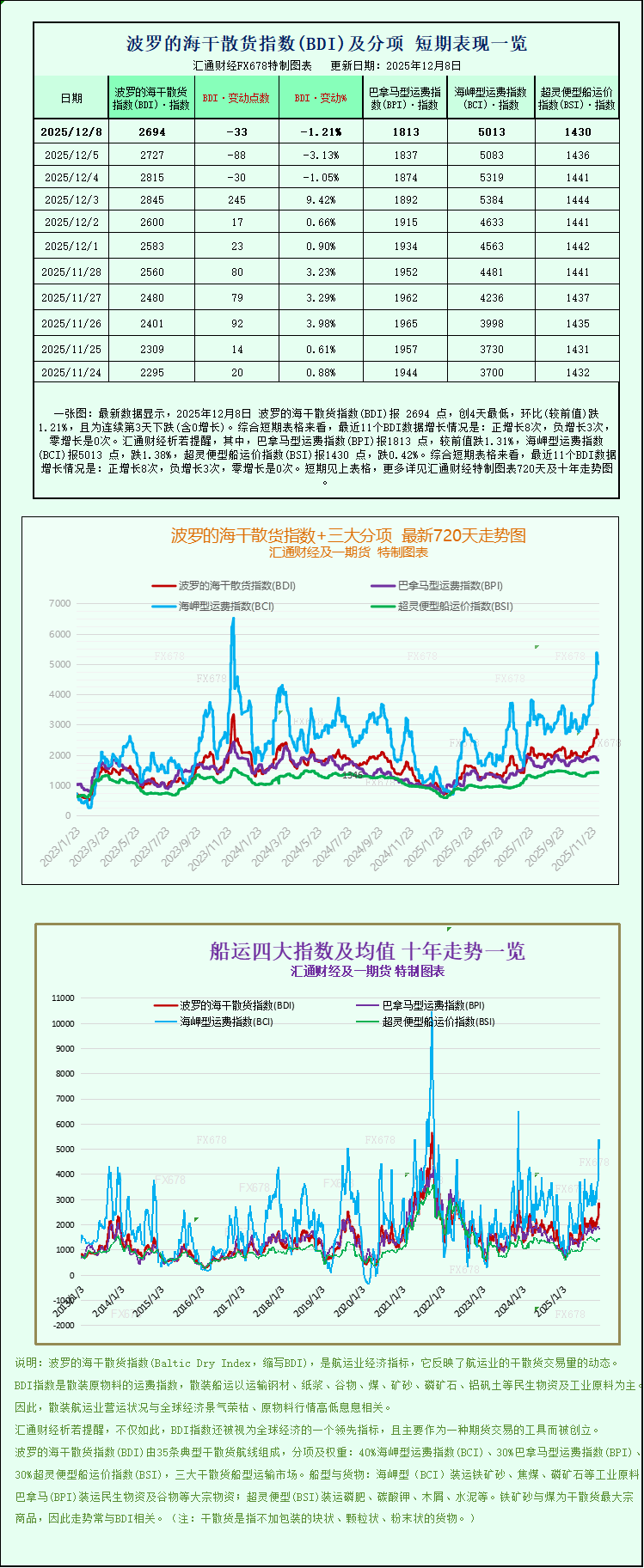

A chart shows that freight rates across all sectors of the Baltic Dry Index weakened, continuing their downward trend.

2025-12-08 23:10:15

Dragged down by a broad decline in freight rates for all types of vessels, the Baltic Dry Index (BDI), a key indicator of the global dry bulk shipping market, continued its downward trend on Monday. Market trading became more cautious, and the overall pressure was particularly pronounced.

The Baltic Dry Index (BDI), which reflects freight rates for the three main vessel types—Capesize, Panamax, and Supramax—fell into a downward trend for the third consecutive trading day, dropping 33 points, or 1.2%, to close at 2694 points. This continuous decline not only directly reflects the imbalance between supply and demand in the market but also indicates a lack of strong support for overall demand in the dry bulk shipping market, leading to a decline in shipping industry confidence regarding the future.

The Capesize freight rate index also declined, falling 70 points in a single day, a drop of about 1.4%, bringing the index back to 5013 points. The continued decline in freight rates for this type of vessel further dragged down the overall index performance.

As the undisputed "bellwether" of the dry bulk shipping market, Capesize vessels, with their 150,000-ton deadweight tonnage, have long been responsible for the long-distance transport of bulk commodities such as iron ore and coal. Their freight rate fluctuations are highly correlated with the activity of global commodity trade. Directly affected by the recent freight rate decline, the average daily profit of this type of vessel has decreased by $580 to $41,571, further squeezing shipowners' profit margins.

It is worth noting that iron ore futures prices in both domestic and international markets declined simultaneously on the same day, further dampening sentiment in the dry bulk shipping market. As the world's largest consumer of iron ore, China's domestic ports and steel mills are gradually entering a concentrated maintenance cycle, leading to a temporary contraction in iron ore procurement demand.

The Panamax freight index also failed to escape its downward trend, falling 24 points, or 1.3%, to close at 1813 points, the lowest level since November 5. This is another low point for the index after several consecutive days of decline.

Panamax vessels typically have a deadweight tonnage between 60,000 and 70,000 tons, primarily transporting small-volume bulk cargoes such as coal and grain. Their freight rates are closely linked to regional energy and food trade. Dragged down by declining freight rates, the average daily profit for this type of vessel decreased by $217 to $16,313. This drop in profitability has also led shipowners to become more conservative in their capacity deployment.

The market for small-tonnage vessels was not spared either, with the Supramax freight rate index falling 6 points to close at 1430, continuing its recent weak trend. Market analysis points out that Supramax vessels mainly serve cargo transportation between small and medium-sized ports, and their weakening freight rates reflect a contraction in demand for dry bulk trade within the region.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.