A chart shows that freight rates across all ship types have weakened, with the Baltic Dry Index falling to a two-week low.

2025-12-10 23:22:50

On Wednesday, the Baltic Dry Index, which tracks dry bulk shipping freight rates, continued its decline, hitting a two-week low. This trend was mainly dragged down by a simultaneous drop in freight rates across all vessel types, putting significant pressure on the overall market and indicating a weak adjustment pattern in the dry bulk shipping market in the short term.

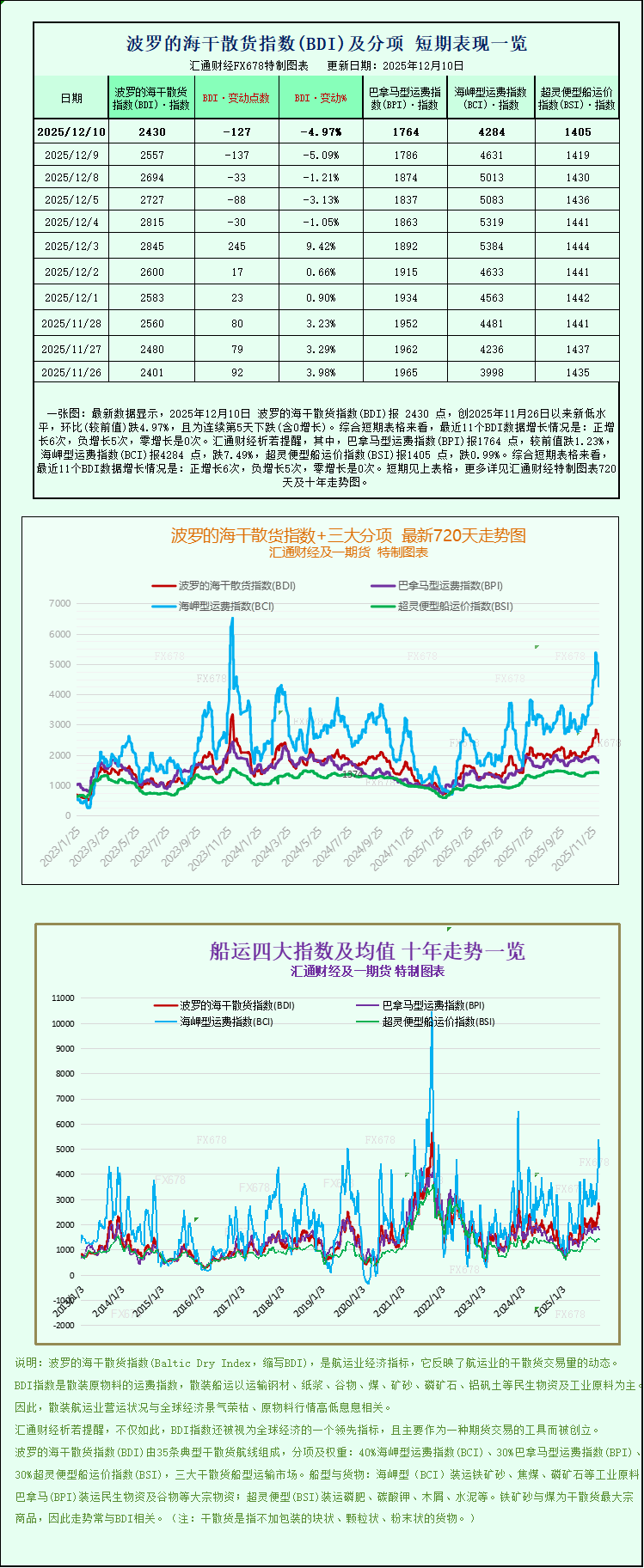

The main index covering freight rates for three core vessel types—Capesize, Panamax, and Supramax—fell 127 points, or 5%, to close at 2430 points. This is the lowest level since November 26 and represents a cumulative drop of over 8% from recent highs, reflecting the overall weakness in demand in the dry bulk shipping market.

The Capesize index was particularly weak, plunging 347 points, or about 7.5%, to close at 4284 points, hitting a near two-week low. As a heavyweight player in the dry bulk shipping market, the freight rate fluctuations of Capesize vessels have a significant impact on the overall index trend. This sharp decline highlights the temporary contraction in demand for large dry bulk shipping.

The average daily earnings of Capesize vessels also declined. These vessels primarily transport bulk dry cargoes such as iron ore and coal, with a typical capacity of around 150,000 tons per vessel. Their average daily earnings decreased by $2,876 to $35,527. This double decline in freight rates and earnings is closely related to the decrease in global commodity trading activity and the slowdown in cargo owners' transportation demand.

It is worth noting that iron ore futures prices, a core cargo transported by Capesize vessels, rebounded on Wednesday, ending a multi-day decline. The main driving factor was weaker-than-expected factory data released by China, the world's largest iron ore consumer. The market widely anticipates that China may launch a new round of economic stimulus policies in 2026 to boost economic growth, thereby driving up demand for industrial raw materials such as iron ore and creating potential positive expectations for the dry bulk shipping market.

The Panamax index fell 22 points, or 1.2%, to close at 1764, its lowest level since October 9. Panamax vessels, a mainstay of the dry bulk shipping market, primarily transport goods such as coal and grain; the decline in their freight rates further confirms the overall weakness of the dry bulk shipping market.

Panamax vessels also saw a slight decline in average daily earnings. These vessels typically have a capacity of 60,000 to 70,000 tons, with average daily earnings decreasing by $200 to $15,878. Although the decline was less than that of Capesize vessels, the continued decrease in earnings still reflects weak market demand and relatively strong bargaining power among cargo owners.

In the small and medium-sized vessel sector, the Supramax index fell 14 points to close at 1405. Supramax vessels, known for their flexibility in adapting to various niche dry bulk shipping needs, saw their index decline, indicating that the small and medium-sized dry bulk shipping market was also affected by overall weak demand, with all vessel types experiencing downward pressure on freight rates.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.